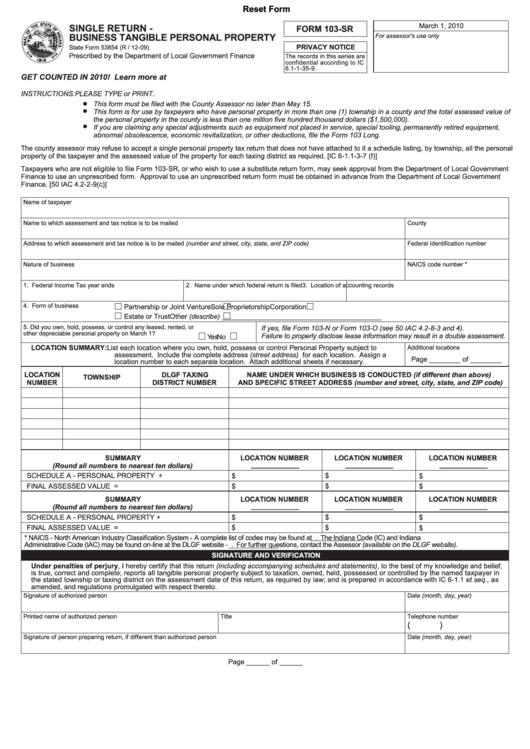

Reset Form

March 1, 2010

SINGLE RETURN -

FORM 103-SR

BUSINESS TANGIBLE PERSONAL PROPERTY

PRIVACY NOTICE

State Form 53854 (R / 12-09)

Prescribed by the Department of Local Government Finance

The records in this series are

confidential according to IC

6.1-1-35-9.

GET COUNTED IN 2010! Learn more at

The county assessor may refuse to accept a single personal property tax return that does not have attached to it a schedule listing, by township, all the personal

property of the taxpayer and the assessed value of the property for each taxing district as required. [IC 6-1.1-3-7 (f)]

T axpayers who are not eligible to file Form 103-SR, or who wish to use a substitute return form, may seek approval from the Department of Local Government

Finance to use an unprescribed form. Approval to use an unprescribed return form must be obtained in advance from the Department of Local Government

Finance. [50 IAC 4.2-2-9(c)]

Name of taxpayer

Name to which assessment and tax notice is to be mailed

County

Address to which assessment and tax notice is to be mailed

Federal Identification number

Nature of business

NAICS code number *

1. Federal Income Tax year ends

2. Name under which federal return is filed

3. Location of accounting records

4. Form of business

Partnership or Joint Venture

Sole Proprietorship

Corporation

Estate or Trust

Other

_________________________________________

5. Did you own, hold, possess, or control any leased, rented, or

other depreciable personal property on March 1?

Yes

No

LOCATION SUMMARY: List each location where you own, hold, possess or control Personal Property subject to

Additional locations

assessment. Include the complete address

for each location. Assign a

Page ________ of ________

location number to each separate location. Attach additional sheets if necessary.

LOCATION

DLGF TAXING

NAME UNDER WHICH BUSINESS IS CONDUCTED (if different than above)

TOWNSHIP

NUMBER

DISTRICT NUMBER

AND SPECIFIC STREET ADDRESS (number and street, city, state, and ZIP code)

SUMMARY

LOCATION NUMBER

LOCATION NUMBER

LOCATION NUMBER

____________

____________

____________

(Round all numbers to nearest ten dollars)

SCHEDULE A - PERSONAL PROPERTY

+

$

$

$

FINAL ASSESSED VALUE

=

$

$

$

SUMMARY

LOCATION NUMBER

LOCATION NUMBER

LOCATION NUMBER

____________

____________

____________

(Round all numbers to nearest ten dollars)

SCHEDULE A - PERSONAL PROPERTY

+

$

$

$

FINAL ASSESSED VALUE

=

$

$

$

* NAICS - North American Industry Classification System - A complete list of codes may be found at . The Indiana Code (IC) and Indiana

Administrative Code (IAC) may be found on-line at the DLGF website - . For further questions, contact the Assessor

SIGNATURE AND VERIFICATION

Under penalties of perjury, I hereby certify that this return

, to the best of my knowledge and belief,

is true, correct and complete; reports all tangible personal property subject to taxation, owned, held, possessed or controlled by the named taxpayer in

the stated township or taxing district on the assessment date of this return, as required by law; and is prepared in accordance with IC 6-1.1

as

amended, and regulations promulgated with respect thereto.

Signature of authorized person

Date

Printed name of authorized person

Title

T elephone number

(

)

Signature of person preparing return, if different than authorized person

Date

Page ______ of ______

1

1 2

2