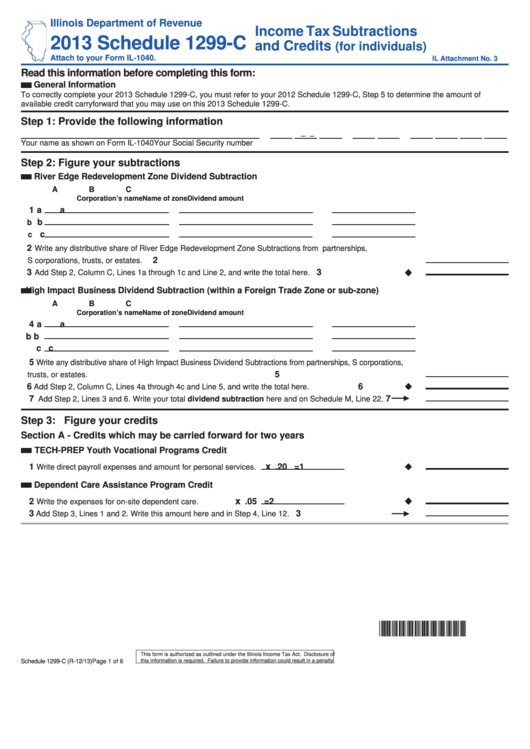

Illinois Department of Revenue

Income Tax Subtractions

2013 Schedule 1299-C

and Credits

(for individuals)

Attach to your Form IL-1040.

IL Attachment No. 3

Read this information before completing this form:

General Information

To correctly complete your 2013 Schedule 1299-C, you must refer to your 2012 Schedule 1299-C, Step 5 to determine the amount of

available credit carryforward that you may use on this 2013 Schedule 1299-C.

Step 1: Provide the following information

–

–

Your name as shown on Form IL-1040

Your Social Security number

Step 2: Figure your subtractions

River Edge Redevelopment Zone Dividend Subtraction

A

B

C

Corporation’s name

Name of zone

Dividend amount

1 a

a

b

b

c

c

2

Write any distributive share of River Edge Redevelopment Zone Subtractions from partnerships,

2

S corporations, trusts, or estates.

3

3

Add Step 2, Column C, Lines 1a through 1c and Line 2, and write the total here.

High Impact Business Dividend Subtraction (within a Foreign Trade Zone or sub-zone)

A

B

C

Corporation’s name

Name of zone

Dividend amount

4 a

a

b

b

c

c

5

Write any distributive share of High Impact Business Dividend Subtractions from partnerships, S corporations,

5

trusts, or estates.

6

6

Add Step 2, Column C, Lines 4a through 4c and Line 5, and write the total here.

7

7

Add Step 2, Lines 3 and 6. Write your total dividend subtraction here and on Schedule M, Line 22.

Step 3: Figure your credits

Section A - Credits which may be carried forward for two years

TECH-PREP Youth Vocational Programs Credit

x

1

.20 =

1

Write direct payroll expenses and amount for personal services.

Dependent Care Assistance Program Credit

x

2

.05 =

2

Write the expenses for on-site dependent care.

3

3

Add Step 3, Lines 1 and 2. Write this amount here and in Step 4, Line 12.

*361601110*

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

this information is required. Failure to provide information could result in a penalty.

Schedule 1299-C (R-12/13)

Page 1 of 6

1

1 2

2 3

3 4

4 5

5 6

6