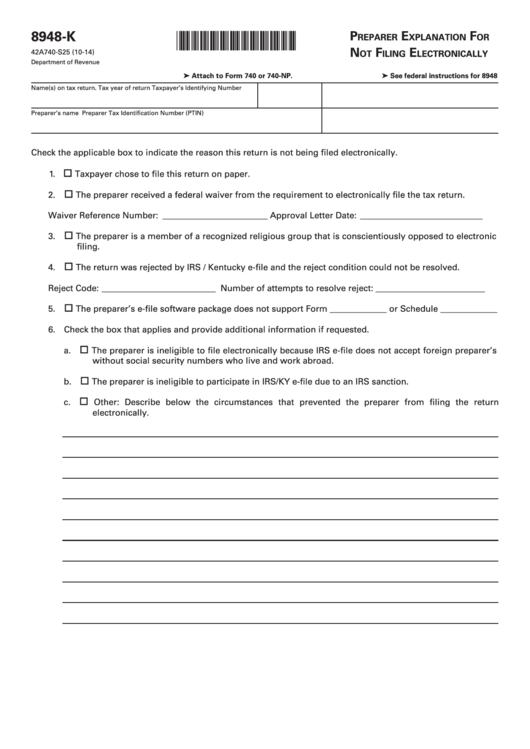

Form 8948-K - Preparer Explanation For Not Filing Electronically - Kentucky Department Of Revenue

ADVERTISEMENT

8948-K

P

e

F

*1400010048*

reParer

xPlanation

or

n

F

e

42A740-S25 (10-14)

ot

iling

lectronically

Department of Revenue

➤ Attach to Form 740 or 740-NP .

➤ See federal instructions for 8948

Name(s) on tax return.

Tax year of return

Taxpayer’s Identifying Number

Preparer’s name

Preparer Tax Identification Number (PTIN)

Check the applicable box to indicate the reason this return is not being filed electronically.

1.

Taxpayer chose to file this return on paper.

2.

The preparer received a federal waiver from the requirement to electronically file the tax return.

Waiver Reference Number: ________________________ Approval Letter Date: ____________________________

3.

The preparer is a member of a recognized religious group that is conscientiously opposed to electronic

filing.

4.

The return was rejected by IRS / Kentucky e-file and the reject condition could not be resolved.

Reject Code: __________________________ Number of attempts to resolve reject: _________________________

5.

The preparer’s e-file software package does not support Form _____________ or Schedule _____________

6. Check the box that applies and provide additional information if requested.

a.

The preparer is ineligible to file electronically because IRS e-file does not accept foreign preparer’s

without social security numbers who live and work abroad.

b.

The preparer is ineligible to participate in IRS/KY e-file due to an IRS sanction.

c.

Other: Describe below the circumstances that prevented the preparer from filing the return

electronically.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1