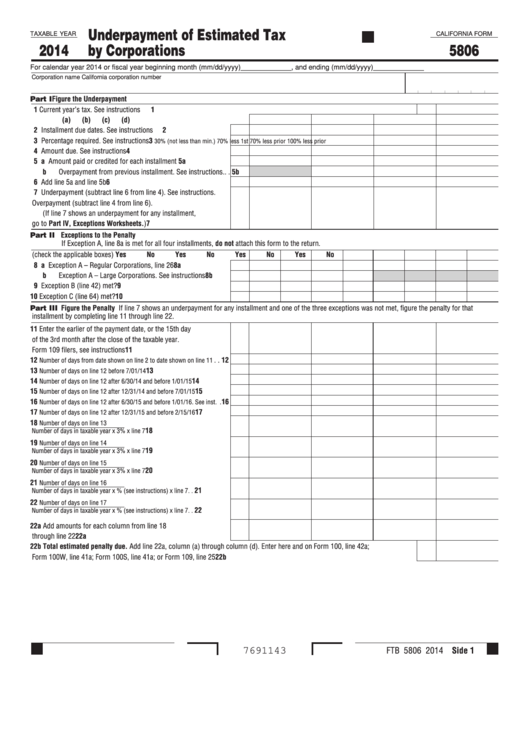

California Form 5806 - Underpayment Of Estimated Tax By Corporations - 2014

ADVERTISEMENT

Underpayment of Estimated Tax

TAXABLE YEAR

CALIFORNIA FORM

by Corporations

2014

5806

For calendar year 2014 or fiscal year beginning month (mm/dd/yyyy)_____________, and ending (mm/dd/yyyy)_____________

Corporation name

California corporation number

Part I

Figure the Underpayment

1 Current year’s tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

(a)

(b)

(c)

(d)

2 Installment due dates. See instructions . . . . . . . . . . . . . . . . . . .

2

3 Percentage required. See instructions . . . . . . . . . . . . . . . . . . . .

3

30% (not less than min.)

70% less 1st

70% less prior

100% less prior

4 Amount due. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 a Amount paid or credited for each installment . . . . . . . . . . . .

5a

b Overpayment from previous installment. See instructions.. .

5b

6 Add line 5a and line 5b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Underpayment (subtract line 6 from line 4). See instructions.

Overpayment (subtract line 4 from line 6).

(If line 7 shows an underpayment for any installment,

go to Part IV, Exceptions Worksheets.) . . . . . . . . . . . . . . . . . .

7

Part II Exceptions to the Penalty

If Exception A, line 8a is met for all four installments, do not attach this form to the return.

(check the applicable boxes)

Yes

No

Yes

No

Yes

No

Yes

No

8 a Exception A – Regular Corporations, line 26. . . . . . . . . . . . .

8a

b Exception A – Large Corporations. See instructions . . . . . . .

8b

9 Exception B (line 42) met? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Exception C (line 64) met? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

Part III Figure the Penalty If line 7 shows an underpayment for any installment and one of the three exceptions was not met, figure the penalty for that

installment by completing line 11 through line 22.

11 Enter the earlier of the payment date, or the 15th day

of the 3rd month after the close of the taxable year.

Form 109 filers, see instructions . . . . . . . . . . . . . . . . . . . . . . . .

11

12

. .

12

Number of days from date shown on line 2 to date shown on line 11

13

. . . . . . . . . . . . . . . . . . . . .

13

Number of days on line 12 before 7/01/14

14

. . . . . . . .

14

Number of days on line 12 after 6/30/14 and before 1/01/15

15

. . . . . . .

15

Number of days on line 12 after 12/31/14 and before 7/01/15

16

.

16

Number of days on line 12 after 6/30/15 and before 1/01/16. See inst.

17

. . . . . . .

17

Number of days on line 12 after 12/31/15 and before 2/15/16

18

Number of days on line 13

18

Number of days in taxable year

x 3% x line 7 . . . . . . . . . . . . . . .

19

Number of days on line 14

19

Number of days in taxable year

x 3% x line 7 . . . . . . . . . . . . . . .

20

Number of days on line 15

20

Number of days in taxable year

x 3% x line 7 . . . . . . . . . . . . . . .

21

Number of days on line 16

21

Number of days in taxable year

x % (see instructions) x line 7 . .

22

Number of days on line 17

22

Number of days in taxable year

x % (see instructions) x line 7 . .

22a Add amounts for each column from line 18

through line 22. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22a

22b Total estimated penalty due. Add line 22a, column (a) through column (d). Enter here and on Form 100, line 42a;

Form 100W, line 41a; Form 100S, line 41a; or Form 109, line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22b

FTB 5806 2014 Side 1

7691143

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5