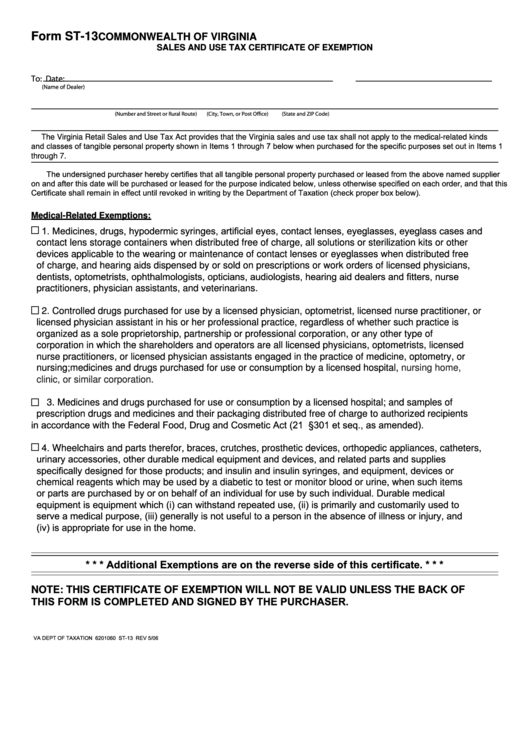

Form ST-13

COMMONWEALTH OF VIRGINIA

SALES AND USE TAX CERTIFICATE OF EXEMPTION

To:

Date:

(Name of Dealer)

(Number and Street or Rural Route)

(City, Town, or Post Office)

(State and ZIP Code)

The Virginia Retail Sales and Use Tax Act provides that the Virginia sales and use tax shall not apply to the medical-related kinds

and classes of tangible personal property shown in Items 1 through 7 below when purchased for the specific purposes set out in Items 1

through 7.

The undersigned purchaser hereby certifies that all tangible personal property purchased or leased from the above named supplier

on and after this date will be purchased or leased for the purpose indicated below, unless otherwise specified on each order, and that this

Certificate shall remain in effect until revoked in writing by the Department of Taxation (check proper box below).

Medical-Related Exemptions:

1. Medicines, drugs, hypodermic syringes, artificial eyes, contact lenses, eyeglasses, eyeglass cases and

contact lens storage containers when distributed free of charge, all solutions or sterilization kits or other

devices applicable to the wearing or maintenance of contact lenses or eyeglasses when distributed free

of charge, and hearing aids dispensed by or sold on prescriptions or work orders of licensed physicians,

dentists, optometrists, ophthalmologists, opticians, audiologists, hearing aid dealers and fitters, nurse

practitioners, physician assistants, and veterinarians.

2. Controlled drugs purchased for use by a licensed physician, optometrist, licensed nurse practitioner, or

licensed physician assistant in his or her professional practice, regardless of whether such practice is

organized as a sole proprietorship, partnership or professional corporation, or any other type of

corporation in which the shareholders and operators are all licensed physicians, optometrists, licensed

nurse practitioners, or licensed physician assistants engaged in the practice of medicine, optometry, or

nursing; medicines and drugs purchased for use or consumption by a licensed hospital,

nursing home,

clinic, or similar corporation.

3. Medicines and drugs purchased for use or consumption by a licensed hospital; and samples of

prescription drugs and medicines and their packaging distributed free of charge to authorized recipients

in accordance with the Federal Food, Drug and Cosmetic Act (21 U.S.C.A. §301 et seq., as amended).

4. Wheelchairs and parts therefor, braces, crutches, prosthetic devices, orthopedic appliances, catheters,

urinary accessories, other durable medical equipment and devices, and related parts and supplies

specifically designed for those products; and insulin and insulin syringes, and equipment, devices or

chemical reagents which may be used by a diabetic to test or monitor blood or urine, when such items

or parts are purchased by or on behalf of an individual for use by such individual. Durable medical

equipment is equipment which (i) can withstand repeated use, (ii) is primarily and customarily used to

serve a medical purpose, (iii) generally is not useful to a person in the absence of illness or injury, and

(iv) is appropriate for use in the home.

* * * Additional Exemptions are on the reverse side of this certificate. * * *

NOTE: THIS CERTIFICATE OF EXEMPTION WILL NOT BE VALID UNLESS THE BACK OF

THIS FORM IS COMPLETED AND SIGNED BY THE PURCHASER.

VA DEPT OF TAXATION 6201060 ST-13 REV 5/06

1

1 2

2