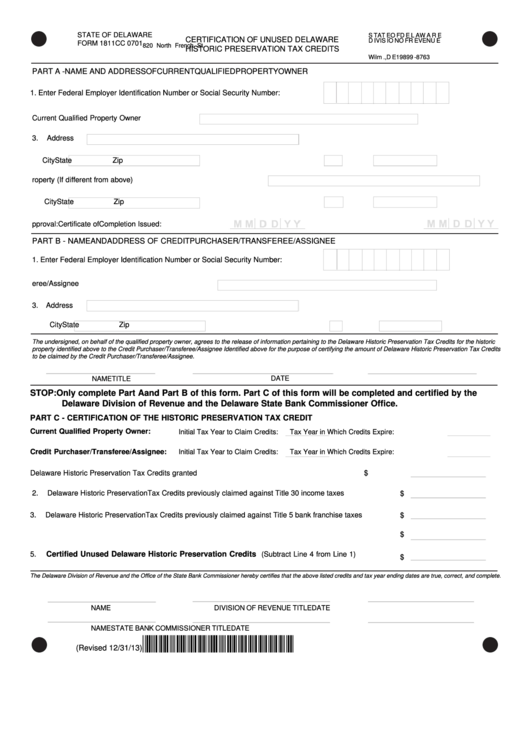

Form 1811cc - Certification Of Unused Delaware Historic Preservation Tax Credits

ADVERTISEMENT

STATE OF DELAWARE

S T A T E O F D E L A W A R E

CERTIFICATION OF UNUSED DELAWARE

D IVIS IO N O F R EV EN U E

FORM 1811CC 0701

8 2 0 No r th F re n c h S t.

HISTORIC PRESERVATION TAX CREDITS

P.O . B o x 8 763

W il m ., D E 19899 - 8763

PART A - NAME AND ADDRESS OF CURRENT QUALIFIED PROPERTY OWNER

1. Enter Federal Employer Identification Number

or

Social Security Number:

2. Name of Current Qualified Property Owner

3.

Address

City

State

Zip

4. Location of Qualifying Historic Property (If different from above)

City

State

Zip

5. Qualifying Dates

Stage II Approval:

Certificate of Completion Issued:

PART B - NAME AND ADDRESS OF CREDIT PURCHASER/TRANSFEREE/ASSIGNEE

1. Enter Federal Employer Identification Number

or

Social Security Number:

2. Name of Credit Purchaser/Transferee/Assignee

3.

Address

City

State

Zip

The undersigned, on behalf of the qualified property owner, agrees to the release of information pertaining to the Delaware Historic Preservation Tax Credits for the historic

property identified above to the Credit Purchaser/Transferee/Assignee Identified above for the purpose of certifying the amount of Delaware Historic Preservation Tax Credits

to be claimed by the Credit Purchaser/Transferee/Assignee.

DATE

NAME

TITLE

STOP: Only complete Part A and Part B of this form. Part C of this form will be completed and certified by the

Delaware Division of Revenue and the Delaware State Bank Commissioner Office.

PART C - CERTIFICATION OF THE HISTORIC PRESERVATION TAX CREDIT

Current Qualified Property Owner:

Initial Tax Year to Claim Credits:

Tax Year in Which Credits Expire:

Credit Purchaser/Transferee/Assignee:

Initial Tax Year to Claim Credits:

Tax Year in Which Credits Expire:

1.

Total Delaware Historic Preservation Tax Credits granted

$

2.

Delaware Historic Preservation Tax Credits previously claimed against Title 30 income taxes

$

3.

Delaware Historic Preservation Tax Credits previously claimed against Title 5 bank franchise taxes

$

4.

Subtotal. Add Line 2 and Line 3

$

5.

Certified Unused Delaware Historic Preservation Credits

(Subtract Line 4 from Line 1)

$

The Delaware Division of Revenue and the Office of the State Bank Commissioner hereby certifies that the above listed credits and tax year ending dates are true, correct, and complete.

NAME

DIVISION OF REVENUE TITLE

DATE

NAME

STATE BANK COMMISSIONER TITLE

DATE

*DF41913019999*

(Revised 12/31/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2