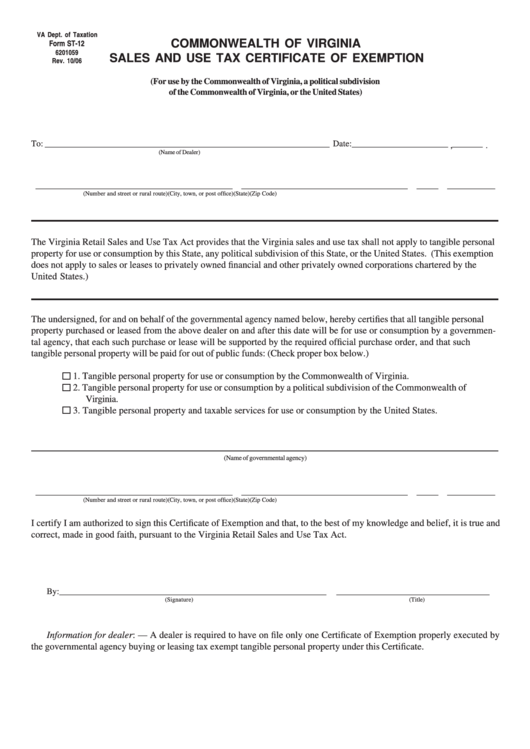

VA Dept. of Taxation

Form ST-12

COMMONWEALTH OF VIRGINIA

6201059

SALES AND USE TAX CERTIFICATE OF EXEMPTION

Rev. 10/06

(For use by the Commonwealth of Virginia, a political subdivision

of the Commonwealth of Virginia, or the United States)

To: _________________________________________________________________ Date: ______________________ , _______ .

(Name of Dealer)

_____________________________________________

t

______________________________________

t

_____

t

___________

(Number and street or rural route)

(City, town, or post office)

(State)

(Zip Code)

The Virginia Retail Sales and Use Tax Act provides that the Virginia sales and use tax shall not apply to tangible personal

property for use or consumption by this State, any political subdivision of this State, or the United States. (This exemption

does not apply to sales or leases to privately owned financial and other privately owned corporations chartered by the

United States.)

The undersigned, for and on behalf of the governmental agency named below, hereby certifies that all tangible personal

property purchased or leased from the above dealer on and after this date will be for use or consumption by a governmen-

tal agency, that each such purchase or lease will be supported by the required official purchase order, and that such

tangible personal property will be paid for out of public funds: (Check proper box below.)

1. Tangible personal property for use or consumption by the Commonwealth of Virginia.

2. Tangible personal property for use or consumption by a political subdivision of the Commonwealth of

Virginia.

3. Tangible personal property and taxable services for use or consumption by the United States.

(Name of governmental agency)

_____________________________________________

t

______________________________________

t

_____

t

___________

(Number and street or rural route)

(City, town, or post office)

(State)

(Zip Code)

I certify I am authorized to sign this Certificate of Exemption and that, to the best of my knowledge and belief, it is true and

correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

By: _____________________________________________________________

f

___________________________________

(Signature)

(Title)

Information for dealer: — A dealer is required to have on file only one Certificate of Exemption properly executed by

the governmental agency buying or leasing tax exempt tangible personal property under this Certificate.

1

1