Form 32-001 - Retailer'S Use Tax Instructions And Worksheet

ADVERTISEMENT

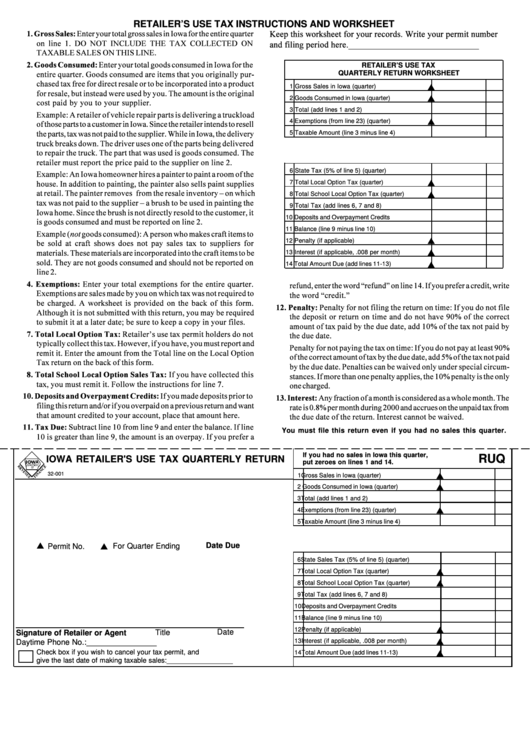

RETAILER’S USE TAX INSTRUCTIONS AND WORKSHEET

RETAILER’S USE TAX

QUARTERLY RETURN WORKSHEET

1 Gross Sales in Iowa (quarter)

2 Goods Consumed in Iowa (quarter)

3 Total (add lines 1 and 2)

4 Exemptions (from line 23) (quarter)

5 Taxable Amount (line 3 minus line 4)

6 State Tax (5% of line 5) (quarter)

7 Total Local Option Tax (quarter)

8 Total School Local Option Tax (quarter)

9 Total Tax (add lines 6, 7 and 8)

10 Deposits and Overpayment Credits

11 Balance (line 9 minus line 10)

12 Penalty (if applicable)

13 Interest (if applicable, .008 per month)

14 Total Amount Due (add lines 11-13)

You must file this return even if you had no sales this quarter.

If you had no sales in Iowa this quarter,

RUQ

IOWA RETAILER'S USE TAX QUARTERLY RETURN

put zeroes on lines 1 and 14.

32-001

1 Gross Sales in Iowa (quarter)

2 Goods Consumed in Iowa (quarter)

3 Total (add lines 1 and 2)

4 Exemptions (from line 23) (quarter)

5 Taxable Amount (line 3 minus line 4)

Date Due

Permit No.

For Quarter Ending

6 State Sales Tax (5% of line 5) (quarter)

7 Total Local Option Tax (quarter)

8 Total School Local Option Tax (quarter)

9 Total Tax (add lines 6, 7 and 8)

10 Deposits and Overpayment Credits

11 Balance (line 9 minus line 10)

12 Penalty (if applicable)

Title

Date

Signature of Retailer or Agent

13 Interest (if applicable, .008 per month)

Daytime Phone No.: ________________

Check box if you wish to cancel your tax permit, and

14 Total Amount Due (add lines 11-13)

give the last date of making taxable sales: _________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2