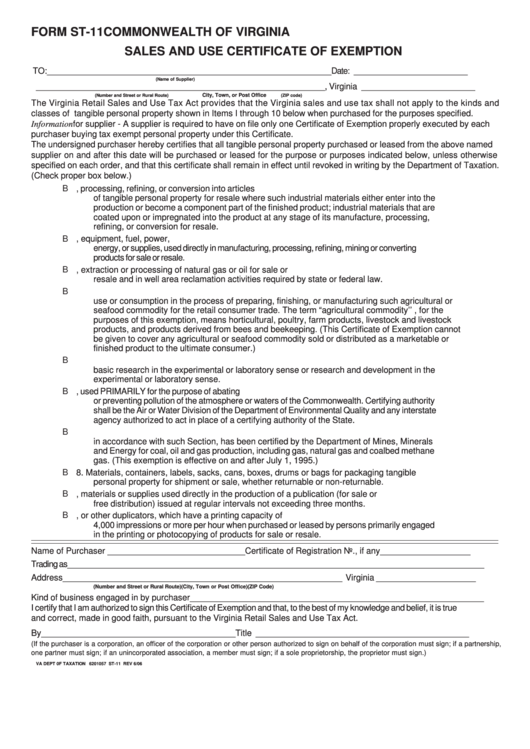

FORM ST-11

COMMONWEALTH OF VIRGINIA

SALES AND USE CERTIFICATE OF EXEMPTION

TO: ____________________________________________________________

Date: ________________________

(Name of Supplier)

_____________________________________________________________

, Virginia ________________________

City, Town, or Post Office

(Number and Street or Rural Route)

(ZIP code)

The Virginia Retail Sales and Use Tax Act provides that the Virginia sales and use tax shall not apply to the kinds and

classes of tangible personal property shown in Items I through 10 below when purchased for the purposes specified.

Information for supplier - A supplier is required to have on file only one Certificate of Exemption properly executed by each

purchaser buying tax exempt personal property under this Certificate.

The undersigned purchaser hereby certifies that all tangible personal property purchased or leased from the above named

supplier on and after this date will be purchased or leased for the purpose or purposes indicated below, unless otherwise

specified on each order, and that this certificate shall remain in effect until revoked in writing by the Department of Taxation.

(Check proper box below.)

B 1. Industrial materials for future manufacturing, processing, refining, or conversion into articles

of tangible personal property for resale where such industrial materials either enter into the

production or become a component part of the finished product; industrial materials that are

coated upon or impregnated into the product at any stage of its manufacture, processing,

refining, or conversion for resale.

B 2. Machinery or tools or repair parts therefor or replacements. thereof, equipment, fuel, power,

energy, or supplies, used directly in manufacturing, processing, refining, mining or converting

products for sale or resale.

B 3. Items used directly in the drilling, extraction or processing of natural gas or oil for sale or

resale and in well area reclamation activities required by state or federal law.

B 4. Agricultural commodities or seafood purchased for the purpose of acquiring raw products for

use or consumption in the process of preparing, finishing, or manufacturing such agricultural or

seafood commodity for the retail consumer trade. The term “agricultural commodity’’ , for the

purposes of this exemption, means horticultural, poultry, farm products, livestock and livestock

products, and products derived from bees and beekeeping. (This Certificate of Exemption cannot

be given to cover any agricultural or seafood commodity sold or distributed as a marketable or

finished product to the ultimate consumer.)

B 5. Tangible personal property purchased for use or consumption directly and exclusively in

basic research in the experimental or laboratory sense or research and development in the

experimental or laboratory sense.

B 6. Certified pollution control equipment and facilities, used PRIMARILY for the purpose of abating

or preventing pollution of the atmosphere or waters of the Commonwealth. Certifying authority

shall be the Air or Water Division of the Department of Environmental Quality and any interstate

agency authorized to act in place of a certifying authority of the State.

B 7. Certified pollution control equipment and facilities as defined in Section 58.1-3660 and which

in accordance with such Section, has been certified by the Department of Mines, Minerals

and Energy for coal, oil and gas production, including gas, natural gas and coalbed methane

gas. (This exemption is effective on and after July 1, 1995.)

B 8.

Materials, containers, labels, sacks, cans, boxes, drums or bags for packaging tangible

personal property for shipment or sale, whether returnable or non-returnable.

B 9. Equipment, materials or supplies used directly in the production of a publication (for sale or

free distribution) issued at regular intervals not exceeding three months.

B 10. High speed electrostatic duplicators, or other duplicators, which have a printing capacity of

4,000 impressions or more per hour when purchased or leased by persons primarily engaged

in the printing or photocopying of products for sale or resale.

Name of Purchaser _____________________________

Certificate of Registration No., if any ___________________

Trading as ________________________________________________________________________________________

Address ___________________________________________________________

Virginia _____________________

(Number and Street or Rural Route)

(City, Town or Post Office)

(ZIP Code)

Kind of business engaged in by purchaser ______________________________________________________________

I certify that I am authorized to sign this Certificate of Exemption and that, to the best of my knowledge and belief, it is true

and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

By _________________________________________

Title _____________________________________________

(If the purchaser is a corporation, an officer of the corporation or other person authorized to sign on behalf of the corporation must sign; if a partnership,

one partner must sign; if an unincorporated association, a member must sign; if a sole proprietorship, the proprietor must sign.)

VA DEPT 0F TAXATION 6201057 ST-11 REV 6/06

1

1