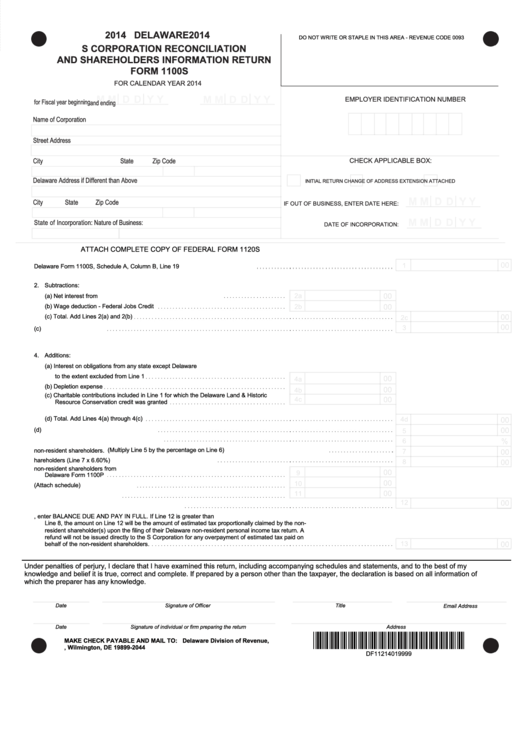

2014 DELAWARE 2014

DO NOT WRITE OR STAPLE IN THIS AREA - REVENUE CODE 0093

S CORPORATION RECONCILIATION

Reset

AND SHAREHOLDERS INFORMATION RETURN

FORM 1100S

Print Form

FOR CALENDAR YEAR 2014

EMPLOYER IDENTIFICATION NUMBER

for Fiscal year beginning

and ending

Name of Corporation

Street Address

City

State

Zip Code

CHECK APPLICABLE BOX:

Delaware Address if Different than Above

INITIAL RETURN

CHANGE OF ADDRESS

EXTENSION ATTACHED

City

State

Zip Code

IF OUT OF BUSINESS, ENTER DATE HERE:

State of Incorporation:

Nature of Business:

DATE OF INCORPORATION:

ATTACH COMPLETE COPY OF FEDERAL FORM 1120S

1. Total Net Income from Delaware Form 1100S, Schedule A, Column B, Line 19

2. Subtractions:

(a) Net interest from U.S. securities to the extent included in Line 1

(b) Wage deduction - Federal Jobs Credit

(c) Total. Add Lines 2(a) and 2(b)

3. Line 1 minus Line 2(c)

4. Additions:

(a) Interest on obligations from any state except Delaware

to the extent excluded from Line 1

(b) Depletion expense

(c) Charitable contributions included in Line 1 for which the Delaware Land & Historic

Resource Conservation credit was granted

(d) Total. Add Lines 4(a) through 4(c)

5. Distributive income. Add Lines 3 and 4(d)

6. Percentage of stock owned by non-residents

7. Distributive income attributable to non-resident shareholders. (Multiply Line 5 by the percentage on Line 6)

8. Tax due on behalf of non-resident shareholders (Line 7 x 6.60%)

9. Estimated tax paid on behalf of non-resident shareholders from

Delaware Form 1100P

10. Other payments (Attach schedule)

11. Approved income tax credits

12. Total payments and credits. Add Lines 9 through 11

13. If Line 8 is greater than Line 12, enter BALANCE DUE AND PAY IN FULL. If Line 12 is greater than

Line 8, the amount on Line 12 will be the amount of estimated tax proportionally claimed by the non-

resident shareholder(s) upon the filing of their Delaware non-resident personal income tax return. A

refund will not be issued directly to the S Corporation for any overpayment of estimated tax paid on

behalf of the non-resident shareholders.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief it is true, correct and complete. If prepared by a person other than the taxpayer, the declaration is based on all information of

which the preparer has any knowledge.

Date

Signature of Officer

Title

Email Address

Date

Signature of individual or firm preparing the return

Address

*DF11214019999*

MAKE CHECK PAYABLE AND MAIL TO: Delaware Division of Revenue,

P.O. Box 2044, Wilmington, DE 19899-2044

DF11214019999

1

1 2

2 3

3 4

4 5

5