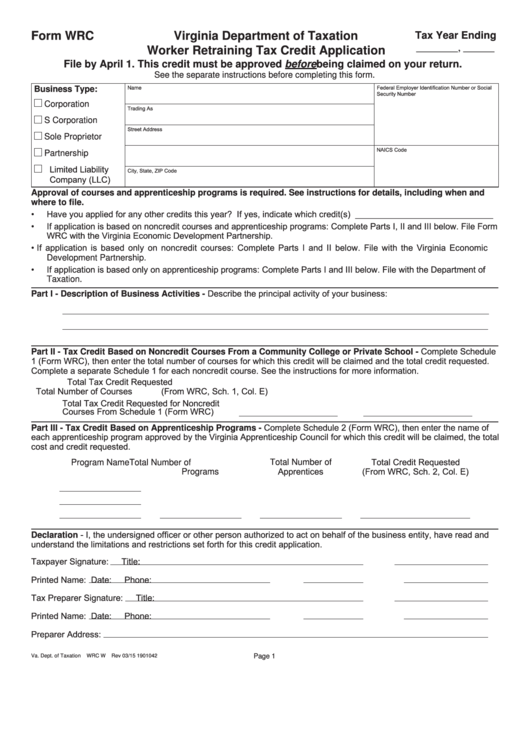

Form WRC

Virginia Department of Taxation

Tax Year Ending

________, ______

Worker Retraining Tax Credit Application

File by April 1. This credit must be approved before being claimed on your return.

See the separate instructions before completing this form.

Federal Employer Identification Number or Social

Business Type:

Name

Security Number

Corporation

Trading As

S Corporation

Street Address

Sole Proprietor

NAICS Code

Partnership

Limited Liability

City, State, ZIP Code

Company (LLC)

Approval of courses and apprenticeship programs is required. See instructions for details, including when and

where to file.

•

Have you applied for any other credits this year? If yes, indicate which credit(s) _____________________________

•

If application is based on noncredit courses and apprenticeship programs: Complete Parts I, II and III below. File Form

WRC with the Virginia Economic Development Partnership.

•

If application is based only on noncredit courses: Complete Parts I and II below. File with the Virginia Economic

Development Partnership.

•

If application is based only on apprenticeship programs: Complete Parts I and III below. File with the Department of

Taxation.

Part I - Description of Business Activities - Describe the principal activity of your business:

Part II - Tax Credit Based on Noncredit Courses From a Community College or Private School - Complete Schedule

1 (Form WRC), then enter the total number of courses for which this credit will be claimed and the total credit requested.

Complete a separate Schedule 1 for each noncredit course. See the instructions for more information.

Total Tax Credit Requested

Total Number of Courses

(From WRC, Sch. 1, Col. E)

Total Tax Credit Requested for Noncredit

Courses From Schedule 1 (Form WRC)

Part III - Tax Credit Based on Apprenticeship Programs - Complete Schedule 2 (Form WRC), then enter the name of

each apprenticeship program approved by the Virginia Apprenticeship Council for which this credit will be claimed, the total

cost and credit requested.

Total Credit Requested

Program Name

Total Number of

Total Number of

Apprentices

(From WRC, Sch. 2, Col. E)

Programs

Declaration - I, the undersigned officer or other person authorized to act on behalf of the business entity, have read and

understand the limitations and restrictions set forth for this credit application.

Taxpayer Signature:

Title:

Printed Name:

Date:

Phone:

Tax Preparer Signature:

Title:

Printed Name:

Date:

Phone:

Preparer Address:

Va. Dept. of Taxation

WRC W

Rev 03/15

1901042

Page 1

1

1 2

2 3

3 4

4 5

5