General Instructions-Bank Franchise Tax Return

ADVERTISEMENT

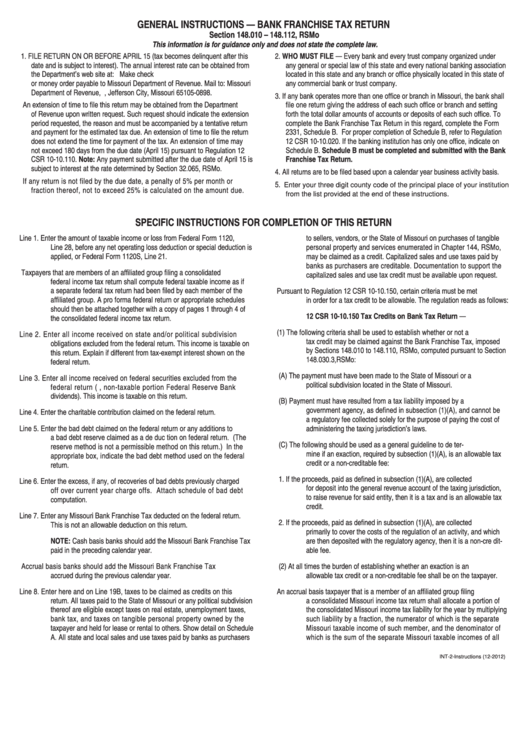

GENERAL INSTRUCTIONS — BANK FRANCHISE TAX RETURN

Section 148.010 – 148.112, RSMo

This information is for guidance only and does not state the complete law.

1. FILE RETURN ON OR BEFORE APRIL 15 (tax becomes delinquent after this

2. WHO MUST FILE — Every bank and every trust company organized under

date and is subject to interest). The annual interest rate can be obtained from

any general or special law of this state and every national banking association

the Department’s web site at: Make check

located in this state and any branch or office physically located in this state of

or money order payable to Missouri Department of Revenue. Mail to: Missouri

any commercial bank or trust company.

Department of Revenue, P.O. Box 898, Jefferson City, Missouri 65105‑0898.

3. If any bank operates more than one office or branch in Missouri, the bank shall

An extension of time to file this return may be obtained from the Department

file one return giving the address of each such office or branch and setting

of Revenue upon written request. Such request should indicate the extension

forth the total dollar amounts of accounts or deposits of each such office. To

period requested, the reason and must be accompanied by a tentative return

complete the Bank Franchise Tax Return in this regard, complete the Form

and payment for the estimated tax due. An extension of time to file the return

2331, Schedule B. For proper completion of Schedule B, refer to Regulation

does not extend the time for payment of the tax. An extension of time may

12 CSR 10‑10.020. If the banking institution has only one office, indicate on

not exceed 180 days from the due date (April 15) pursuant to Regulation 12

Schedule B. Schedule B must be completed and submitted with the Bank

CSR 10‑10.110. Note: Any payment submitted after the due date of April 15 is

Franchise Tax Return.

subject to interest at the rate determined by Section 32.065, RSMo.

4. All returns are to be filed based upon a calendar year business activity basis.

If any return is not filed by the due date, a penalty of 5% per month or

5.

Enter your three digit county code of the principal place of your institution

fraction thereof, not to exceed 25% is calculated on the amount due.

from the list provided at the end of these instructions.

SPECIFIC INSTRUCTIONS FOR COMPLETION OF THIS RETURN

Line 1.

Enter the amount of taxable income or loss from Federal Form 1120,

to sellers, vendors, or the State of Missouri on purchases of tangible

Line 28, before any net operating loss deduction or special deduction is

personal property and services enumerated in Chapter 144, RSMo,

applied, or Federal Form 1120S, Line 21.

may be claimed as a credit. Capitalized sales and use taxes paid by

banks as purchasers are creditable. Documentation to support the

Taxpayers that are members of an affiliated group filing a consolidated

capitalized sales and use tax credit must be available upon request.

federal income tax return shall compute federal taxable income as if

a separate federal tax return had been filed by each member of the

Pursuant to Regulation 12 CSR 10‑10.150, certain criteria must be met

affiliated group. A pro forma federal return or appropriate schedules

in order for a tax credit to be allowable. The regulation reads as follows:

should then be attached together with a copy of pages 1 through 4 of

12 CSR 10‑10.150 Tax Credits on Bank Tax Return —

the consolidated federal income tax return.

(1) The following criteria shall be used to establish whether or not a

Line 2.

Enter all income received on state and/or political subdivision

tax credit may be claimed against the Bank Franchise Tax, imposed

obligations excluded from the federal return. This income is taxable on

by Sections 148.010 to 148.110, RSMo, computed pursuant to Section

this return. Explain if different from tax‑exempt interest shown on the

148.030.3,RSMo:

federal return.

(A) The payment must have been made to the State of Missouri or a

Line 3.

Enter all income received on federal securities excluded from the

political subdivision located in the State of Missouri.

federal return (e.g., non‑taxable portion Federal Reserve Bank

dividends). This income is taxable on this return.

(B) Payment must have resulted from a tax liability imposed by a

government agency, as defined in subsection (1)(A), and cannot be

Line 4.

Enter the charitable contribution claimed on the federal return.

a regulatory fee collected solely for the purpose of paying the cost of

Line 5.

Enter the bad debt claimed on the federal return or any additions to

administering the taxing jurisdiction’s laws.

a bad debt reserve claimed as a de duc tion on federal return. (The

(C) The following should be used as a general guideline to de ter‑

reserve method is not a permissible method on this return.) In the

mine if an exaction, required by subsection (1)(A), is an allowable tax

appropriate box, indicate the bad debt method used on the federal

credit or a non‑creditable fee:

return.

1. If the proceeds, paid as defined in subsection (1)(A), are collected

Line 6.

Enter the excess, if any, of recoveries of bad debts previously charged

for deposit into the general revenue account of the taxing jurisdiction,

off over current year charge offs. Attach schedule of bad debt

to raise revenue for said entity, then it is a tax and is an allowable tax

computation.

credit.

Line 7.

Enter any Missouri Bank Franchise Tax deducted on the federal return.

2. If the proceeds, paid as defined in subsection (1)(A), are collected

This is not an allowable deduction on this return.

primarily to cover the costs of the regulation of an activity, and which

NOTE: Cash basis banks should add the Missouri Bank Franchise Tax

are then deposited with the regulatory agency, then it is a non‑cre dit‑

paid in the preceding calendar year.

able fee.

Accrual basis banks should add the Missouri Bank Franchise Tax

(2) At all times the burden of establishing whether an exaction is an

accrued during the previous calendar year.

allowable tax credit or a non‑creditable fee shall be on the taxpayer.

Line 8.

Enter here and on Line 19B, taxes to be claimed as credits on this

An accrual basis taxpayer that is a member of an affiliated group filing

return. All taxes paid to the State of Missouri or any political subdivision

a consolidated Missouri income tax return shall allocate a portion of

thereof are eligible except taxes on real estate, unemployment taxes,

the consolidated Missouri income tax liability for the year by multiplying

bank tax, and taxes on tangible personal property owned by the

such liability by a fraction, the numerator of which is the separate

taxpayer and held for lease or rental to others. Show detail on Schedule

Missouri taxable income of such member, and the denominator of

A. All state and local sales and use taxes paid by banks as purchasers

which is the sum of the separate Missouri taxable incomes of all

INT‑2‑Instructions (12‑2012)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3