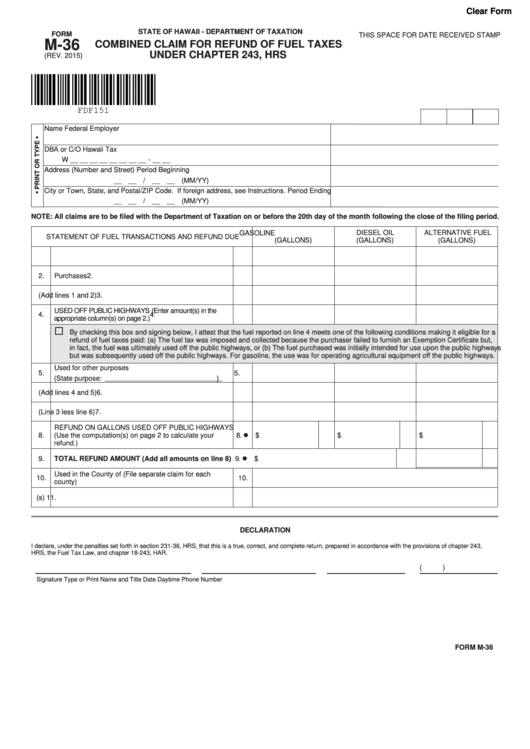

Clear Form

FORM

STATE OF HAWAII - DEPARTMENT OF TAXATION

THIS SPACE FOR DATE RECEIVED STAMP

M-36

COMBINED CLAIM FOR REFUND OF FUEL TAXES

UNDER CHAPTER 243, HRS

(REV. 2015)

FDF151

Name

Federal Employer I.D. No. or Social Security No.

DBA or C/O

Hawaii Tax I.D. No.

W __ __ __ __ __ __ __ __ - __ __

Address (Number and Street)

Period Beginning

__ __ / __ __ (MM/YY)

City or Town, State, and Postal/ZIP Code. If foreign address, see Instructions.

Period Ending

__ __ / __ __ (MM/YY)

NOTE: All claims are to be filed with the Department of Taxation on or before the 20th day of the month following the close of the filing period.

GASOLINE

DIESEL OIL

ALTERNATIVE FUEL

STATEMENT OF FUEL TRANSACTIONS AND REFUND DUE

(GALLONS)

(GALLONS)

(GALLONS)

1.

On hand at beginning of period

1.

2.

Purchases

2.

3.

Total (Add lines 1 and 2)

3.

USED OFF PUBLIC HIGHWAYS (Enter amount(s) in the

4.

4.

appropriate column(s) on page 2.)

By checking this box and signing below, I attest that the fuel reported on line 4 meets one of the following conditions making it eligible for a

refund of fuel taxes paid: (a) The fuel tax was imposed and collected because the purchaser failed to furnish an Exemption Certificate but,

in fact, the fuel was ultimately used off the public highways, or (b) The fuel purchased was initially intended for use upon the public highways

but was subsequently used off the public highways. For gasoline, the use was for operating agricultural equipment off the public highways.

Used for other purposes

5.

5.

(State purpose:

)

6.

Total (Add lines 4 and 5)

6.

7.

On hand at end of period (Line 3 less line 6)

7.

REFUND ON GALLONS USED OFF PUBLIC HIGHWAYS

8. $

8.

(Use the computation(s) on page 2 to calculate your

$

$

refund.)

TOTAL REFUND AMOUNT (Add all amounts on line 8) .................................................................................... 9. $

9.

Used in the County of (File separate claim for each

10.

10.

county)

11.

Name of seller(s)

11.

DECLARATION

I declare, under the penalties set forth in section 231-36, HRS, that this is a true, correct, and complete return, prepared in accordance with the provisions of chapter 243,

HRS, the Fuel Tax Law, and chapter 18-243, HAR.

(

)

Signature

Type or Print Name and Title

Date

Daytime Phone Number

FORM M-36

1

1 2

2