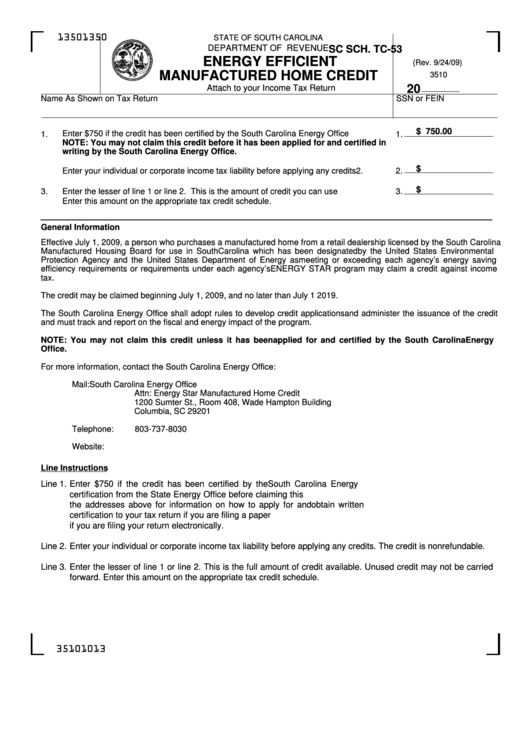

Form Sc Sch. Tc-53 - Energy Efficient Manufactured Home Credit

ADVERTISEMENT

1350

1350

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

SC SCH. TC-53

ENERGY EFFICIENT

(Rev. 9/24/09)

MANUFACTURED HOME CREDIT

3510

20

Attach to your Income Tax Return

SSN or FEIN

Name As Shown on Tax Return

$ 750.00

Enter $750 if the credit has been certified by the South Carolina Energy Office

...................

1.

1.

NOTE: You may not claim this credit before it has been applied for and certified in

writing by the South Carolina Energy Office.

$

................

2.

Enter your individual or corporate income tax liability before applying any credits

2.

$

.......................

3.

Enter the lesser of line 1 or line 2. This is the amount of credit you can use

3.

Enter this amount on the appropriate tax credit schedule.

General Information

Effective July 1, 2009, a person who purchases a manufactured home from a retail dealership licensed by the South Carolina

Manufactured Housing Board for use in South Carolina which has been designated by the United States Environmental

Protection Agency and the United States Department of Energy as meeting or exceeding each agency’s energy saving

efficiency requirements or requirements under each agency’s ENERGY STAR program may claim a credit against income

tax.

The credit may be claimed beginning July 1, 2009, and no later than July 1 2019.

The South Carolina Energy Office shall adopt rules to develop credit applications and administer the issuance of the credit

and must track and report on the fiscal and energy impact of the program.

NOTE: You may not claim this credit unless it has been applied for and certified by the South Carolina Energy

Office.

For more information, contact the South Carolina Energy Office:

Mail:

South Carolina Energy Office

Attn: Energy Star Manufactured Home Credit

1200 Sumter St., Room 408, Wade Hampton Building

Columbia, SC 29201

Telephone:

803-737-8030

Website:

Line Instructions

Line 1.

Enter $750 if the credit has been certified by the South Carolina Energy Office. You must obtain written

certification from the State Energy Office before claiming this credit. Contact the State Energy Office at any of

the addresses above for information on how to apply for and obtain written certification. Attach the written

certification to your tax return if you are filing a paper return. Keep the written certification with your tax records

if you are filing your return electronically.

Line 2.

Enter your individual or corporate income tax liability before applying any credits. The credit is nonrefundable.

Line 3.

Enter the lesser of line 1 or line 2. This is the full amount of credit available. Unused credit may not be carried

forward. Enter this amount on the appropriate tax credit schedule.

35101013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2