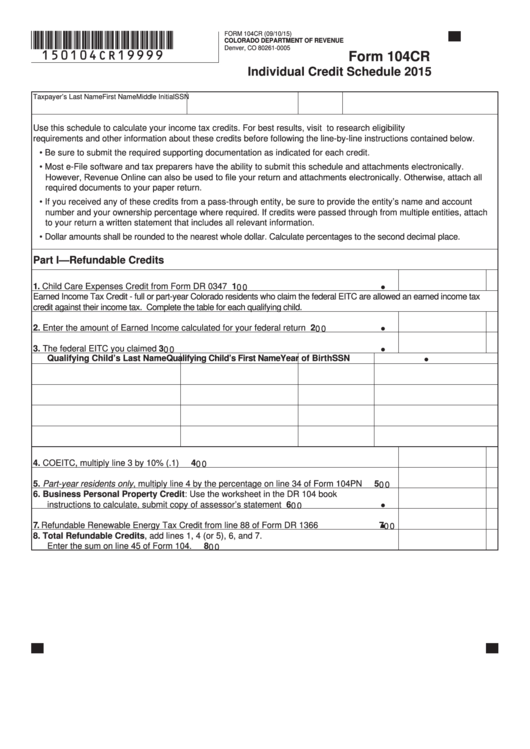

*150104CR19999*

FORM 104CR (09/10/15)

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0005

Form 104CR

Individual Credit Schedule 2015

Taxpayer’s Last Name

First Name

Middle Initial SSN

Use this schedule to calculate your income tax credits. For best results, visit to research eligibility

requirements and other information about these credits before following the line-by-line instructions contained below.

• Be sure to submit the required supporting documentation as indicated for each credit.

• Most e-File software and tax preparers have the ability to submit this schedule and attachments electronically.

However, Revenue Online can also be used to file your return and attachments electronically. Otherwise, attach all

required documents to your paper return.

• If you received any of these credits from a pass-through entity, be sure to provide the entity’s name and account

number and your ownership percentage where required. If credits were passed through from multiple entities, attach

to your return a written statement that includes all relevant information.

• Dollar amounts shall be rounded to the nearest whole dollar. Calculate percentages to the second decimal place.

Part I—Refundable Credits

1. Child Care Expenses Credit from Form DR 0347

1

0 0

Earned Income Tax Credit - full or part-year Colorado residents who claim the federal EITC are allowed an earned income tax

credit against their income tax. Complete the table for each qualifying child.

2. Enter the amount of Earned Income calculated for your federal return

2

0 0

3. The federal EITC you claimed

3

0 0

Qualifying Child’s Last Name

Qualifying Child’s First Name

Year of Birth

SSN

4. COEITC, multiply line 3 by 10% (.1)

4

0 0

5. Part-year residents only, multiply line 4 by the percentage on line 34 of Form 104PN

5

0 0

6. Business Personal Property Credit: Use the worksheet in the DR 104 book

instructions to calculate, submit copy of assessor’s statement

6

0 0

7. Refundable Renewable Energy Tax Credit from line 88 of Form DR 1366

7

0 0

8. Total Refundable Credits, add lines 1, 4 (or 5), 6, and 7.

Enter the sum on line 45 of Form 104.

8

0 0

1

1 2

2 3

3