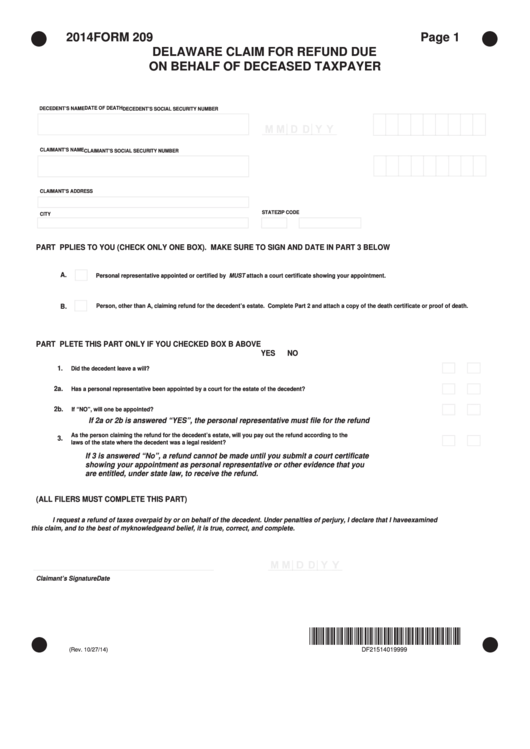

2014

FORM 209

Page 1

DELAWARE CLAIM FOR REFUND DUE

Reset

ON BEHALF OF DECEASED TAXPAYER

Print Form

DATE OF DEATH

DECEDENT’S NAME

DECEDENT’S SOCIAL SECURITY NUMBER

CLAIMANT’S NAME

CLAIMANT’S SOCIAL SECURITY NUMBER

CLAIMANT’S ADDRESS

STATE

ZIP CODE

CITY

PART 1. CHECK THE BOX THAT APPLIES TO YOU (CHECK ONLY ONE BOX). MAKE SURE TO SIGN AND DATE IN PART 3 BELOW

A.

Personal representative appointed or certified by court. You MUST attach a court certificate showing your appointment.

Person, other than A, claiming refund for the decedent’s estate. Complete Part 2 and attach a copy of the death certificate or proof of death.

B.

PART 2. COMPLETE THIS PART ONLY IF YOU CHECKED BOX B ABOVE

YES

NO

1.

Did the decedent leave a will?..................................................................................................................................................................................

2a.

Has a personal representative been appointed by a court for the estate of the decedent?..............................................................................

....

2b.

If “NO”, will one be appointed?................................................................................................................................................................................

If 2a or 2b is answered “YES”, the personal representative must file for the refund

As the person claiming the refund for the decedent’s estate, will you pay out the refund according to the

3.

laws of the state where the decedent was a legal resident?.................................................................................................................................

If 3 is answered “No”, a refund cannot be made until you submit a court certificate

showing your appointment as personal representative or other evidence that you

are entitled, under state law, to receive the refund.

PART 3. SIGNATURE AND VERIFICATION (ALL FILERS MUST COMPLETE THIS PART)

I request a refund of taxes overpaid by or on behalf of the decedent. Under penalties of perjury, I declare that I have examined

this claim, and to the best of my knowledge and belief, it is true, correct, and complete.

Claimant’s Signature

Date

*DF21514019999*

DF21514019999

(Rev. 10/27/14)

1

1