*DO=NOT=SEND*

Alternative Minimum

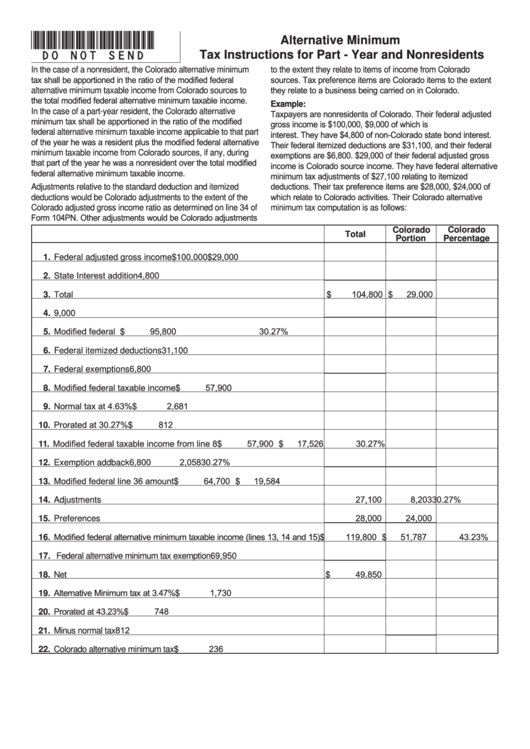

Tax Instructions for Part - Year and Nonresidents

In the case of a nonresident, the Colorado alternative minimum

to the extent they relate to items of income from Colorado

tax shall be apportioned in the ratio of the modified federal

sources. Tax preference items are Colorado items to the extent

they relate to a business being carried on in Colorado.

alternative minimum taxable income from Colorado sources to

the total modified federal alternative minimum taxable income.

Example:

In the case of a part-year resident, the Colorado alternative

Taxpayers are nonresidents of Colorado. Their federal adjusted

minimum tax shall be apportioned in the ratio of the modified

gross income is $100,000, $9,000 of which is U.S. government

federal alternative minimum taxable income applicable to that part

interest. They have $4,800 of non-Colorado state bond interest.

of the year he was a resident plus the modified federal alternative

Their federal itemized deductions are $31,100, and their federal

minimum taxable income from Colorado sources, if any, during

exemptions are $6,800. $29,000 of their federal adjusted gross

that part of the year he was a nonresident over the total modified

income is Colorado source income. They have federal alternative

federal alternative minimum taxable income.

minimum tax adjustments of $27,100 relating to itemized

deductions. Their tax preference items are $28,000, $24,000 of

Adjustments relative to the standard deduction and itemized

which relate to Colorado activities. Their Colorado alternative

deductions would be Colorado adjustments to the extent of the

Colorado adjusted gross income ratio as determined on line 34 of

minimum tax computation is as follows:

Form 104PN. Other adjustments would be Colorado adjustments

Colorado

Colorado

Total

Portion

Percentage

29,000

1. Federal adjusted gross income

$

100,000 $

2. State Interest addition

4,800

3. Total

104,800 $

29,000

$

4. U.S. Interest subtraction

9,000

5. Modified federal A.G.I.

95,800

30.27%

$

6. Federal itemized deductions

31,100

6,800

7. Federal exemptions

8. Modified federal taxable income

57,900

$

9. Normal tax at 4.63%

2,681

$

10. Prorated at 30.27%

812

$

11. Modified federal taxable income from line 8

57,900 $

17,526

30.27%

$

6,800

2,058

30.27%

12. Exemption addback

13. Modified federal line 36 amount

64,700 $

19,584

$

27,100

8,203

30.27%

14. Adjustments

28,000

24,000

15. Preferences

16. Modified federal alternative minimum taxable income (lines 13, 14 and 15) $

119,800 $

51,787

43.23%

17. Federal alternative minimum tax exemption

69,950

49,850

18. Net

$

19. Alternative Minimum tax at 3.47%

1,730

$

20. Prorated at 43.23%

748

$

812

21. Minus normal tax

236

22. Colorado alternative minimum tax

$

1

1 2

2