Clear Form

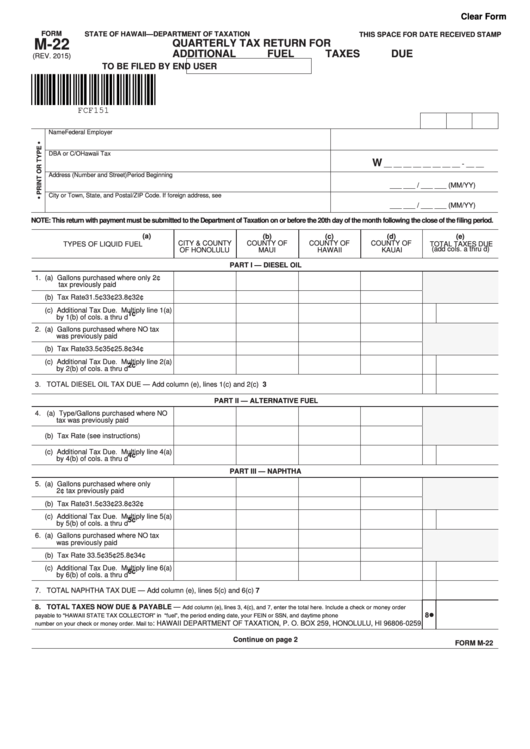

STATE OF HAWAII—DEPARTMENT OF TAXATION

FORM

THIS SPACE FOR DATE RECEIVED STAMP

QUARTERLY TAX RETURN FOR

M-22

ADDITIONAL FUEL TAXES DUE

(REV. 2015)

TO BE FILED BY END USER

FCF151

Name

Federal Employer I.D. No or Social Security No.

DBA or C/O

Hawaii Tax I.D. No.

W

__ __ __ __ __ __ __ __ - __ __

Address (Number and Street)

Period Beginning

___ ___ / ___ ___ (MM/YY)

City or Town, State, and Postal/ZIP Code. If foreign address, see Instructions.

Period Ending

___ ___ / ___ ___ (MM/YY)

NOTE: This return with payment must be submitted to the Department of Taxation on or before the 20th day of the month following the close of the filing period.

(a)

(b)

(c)

(d)

(e)

CITY & COUNTY

COUNTY OF

COUNTY OF

COUNTY OF

TYPES OF LIQUID FUEL

TOTAL TAXES DUE

OF HONOLULU

MAUI

HAWAII

KAUAI

(add cols. a thru d)

PART I — DIESEL OIL

1. (a) Gallons purchased where only 2¢

tax previously paid

(b) Tax Rate

31.5¢

33¢

23.8¢

32¢

(c) Additional Tax Due. Multiply line 1(a)

1c

by 1(b) of cols. a thru d

2. (a) Gallons purchased where NO tax

was previously paid

(b) Tax Rate

33.5¢

35¢

25.8¢

34¢

(c) Additional Tax Due. Multiply line 2(a)

2c

by 2(b) of cols. a thru d

3. TOTAL DIESEL OIL TAX DUE — Add column (e), lines 1(c) and 2(c) ....................................................................................

3

PART II — ALTERNATIVE FUEL

4. (a) Type/Gallons purchased where NO

tax was previously paid

(b) Tax Rate (see instructions)

(c) Additional Tax Due. Multiply line 4(a)

4c

by 4(b) of cols. a thru d

PART III — NAPHTHA

5. (a) Gallons purchased where only

2¢ tax previously paid

(b) Tax Rate

31.5¢

33¢

23.8¢

32¢

(c) Additional Tax Due. Multiply line 5(a)

5c

by 5(b) of cols. a thru d

6. (a) Gallons purchased where NO tax

was previously paid

(b) Tax Rate

33.5¢

35¢

25.8¢

34¢

(c) Additional Tax Due. Multiply line 6(a)

6c

by 6(b) of cols. a thru d

7. TOTAL NAPHTHA TAX DUE — Add column (e), lines 5(c) and 6(c)........................................................................................

7

8. TOTAL TAXES NOW DUE & PAYABLE — Add column (e), lines 3, 4(c), and 7, enter the total here.

Include a check or money order

payable to “HAWAII STATE TAX COLLECTOR” in U.S. dollars with this form. Write “fuel”, the period ending date, your FEIN or SSN, and daytime phone

8

number on your check or money order. Mail to: HAWAII DEPARTMENT OF TAXATION, P. O. BOX 259, HONOLULU, HI 96806-0259.

Continue on page 2

FORM M-22

1

1 2

2