Reset

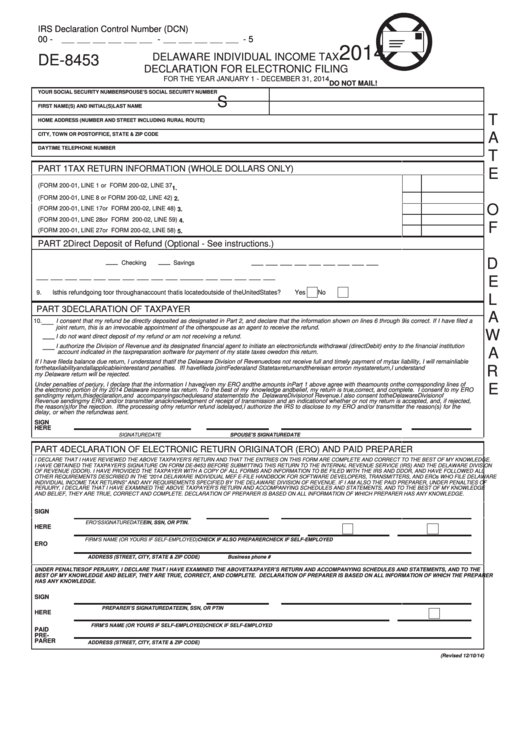

IRS Declaration Control Number (DCN)

Print Form

00 -

-

- 5

2014

DELAWARE INDIVIDUAL INCOME TAX

DE-8453

DECLARATION FOR ELECTRONIC FILING

FOR THE YEAR JANUARY 1 - DECEMBER 31, 2014

DO NOT MAIL!

YOUR SOCIAL SECURITY NUMBER

SPOUSE’S SOCIAL SECURITY NUMBER

S

FIRST NAME(S) AND INITIAL(S)

LAST NAME

T

HOME ADDRESS (NUMBER AND STREET INCLUDING RURAL ROUTE)

A

CITY, TOWN OR POST OFFICE, STATE & ZIP CODE

DAYTIME TELEPHONE NUMBER

T

PART 1

TAX RETURN INFORMATION (WHOLE DOLLARS ONLY)

E

1.

TOTAL DELAWARE ADJUSTED GROSS INCOME (FORM 200-01, LINE 1 or FORM 200-02, LINE 37 ..........................................

1.

2.

TOTAL DELAWARE TAX (FORM 200-01, LINE 8 or FORM 200-02, LINE 42)......................................... . .........................................

2.

O

3.

DELAWARE INCOME TAX WITHHELD (FORM 200-01, LINE 17 or FORM 200-02, LINE 48)........................................................

3.

4.

NET REFUND (FORM 200-01, LINE 28 or FO RM 200-02, LINE 59)...............................................................................................

4.

F

5.

NET BALANCE DUE (FORM 200-01, LINE 27 or FORM 200-02, LINE 58)......................................... . ............................................

5.

PART 2

Direct Deposit of Refund (Optional - See instructions.)

__

__

__ __ __ __ __ __ __ __ __

D

7.

Routing number

6.

Type of Account

Checking

Savings

__ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __

E

8.

Account number

9

.

Is this refund going to or through an account that is located outside of the United States?

Yes

No

L

PART 3

DECLARATION OF TAXPAYER

A

__

10.

I consent that my refund be directly deposited as designated in Part 2, and declare that the information shown on lines 6 through 9 is correct. If I have filed a

joint return, this is an irrevocable appointment of the other spouse as an agent to receive the refund.

W

__

I do not want direct deposit of my refund or am not receiving a refund.

__

I authorize the Division of Revenue and its designated financial agent to initiate an electronic funds withdrawal (direct Debit) entry to the financial institution

A

account indicated in the tax preparation software for payment of my state taxes owed on this return.

If I have filed a balance due return, I understand that if the Delaware Division of Revenue does not receive full and timely payment of my tax liability, I will remain liable

R

for the tax liability and all applicable interest and penalties. If I have filed a joint Federal and State tax return and there is an error on my state return, I understand

my Delaware return will be rejected.

Under penalties of perjury, I declare that the information I have given my ERO and the amounts in Part 1 above agree with the amounts on the corresponding lines of

E

the electronic portion of my 2014 Delaware income tax return. To the best of my knowledge and belief, my return is true, correct, and complete. I consent to my ERO

sending my return, this declaration, and accompanying schedules and statements to the Delaware Division of Revenue. I also consent to the Delaware Division of

Revenue sending my ERO and/or transmitter an acknowledgment of receipt of transmission and an indication of whether or not my return is accepted, and, if rejected,

the reason(s) for the rejection. If the processing of my return or refund is delayed, I authorize the IRS to disclose to my ERO and/or transmitter the reason(s) for the

delay, or when the refund was sent.

SIGN

HERE

SIGNATURE

DATE

SPOUSE’S SIGNATURE

DATE

PART 4

DECLARATION OF ELECTRONIC RETURN ORIGINATOR (ERO) AND PAID PREPARER

I DECLARE THAT I HAVE REVIEWED THE ABOVE TAXPAYER’S RETURN AND THAT THE ENTRIES ON THIS FORM ARE COMPLETE AND CORRECT TO THE BEST OF MY KNOWLEDGE.

I HAVE OBTAINED THE TAXPAYER'S SIGNATURE ON FORM DE-8453 BEFORE SUBMITTING THIS RETURN TO THE INTERNAL REVENUE SERVICE (IRS) AND THE DELAWARE DIVISION

OF REVENUE (DDOR). I HAVE PROVIDED THE TAXPAYER WITH A COPY OF ALL FORMS AND INFORMATION TO BE FILED WITH THE IRS AND DDOR, AND HAVE FOLLOWED ALL

OTHER REQUIREMENTS DESCRIBED IN THE “2014 DELAWARE INDIVIDUAL MEF E-FILE HANDBOOK FOR SOFTWARE DEVELOPERS, TRANSMITTERS, AND EROs WHO FILE DELAWARE

INDIVIDUAL INCOME TAX RETURNS” AND ANY REQUIREMENTS SPECIFIED BY THE DELAWARE DIVISION OF REVENUE. IF I AM ALSO THE PAID PREPARER, UNDER PENALTIES OF

PERJURY, I DECLARE THAT I HAVE EXAMINED THE ABOVE TAXPAYER’S RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF MY KNOWLEDGE

AND BELIEF, THEY ARE TRUE, CORRECT AND COMPLETE. DECLARATION OF PREPARER IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

SIGN

ERO’S SIGNATURE

DATE

EIN, SSN, OR PTIN.

HERE

FIRM’S NAME (OR YOURS IF SELF-EMPLOYED)

CHECK IF ALSO PREPARER

CHECK IF SELF-EMPLOYED

ERO

ADDRESS (STREET, CITY, STATE & ZIP CODE)

Business phone #

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THE ABOVE TAXPAYER’S RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE

BEST OF MY KNOWLEDGE AND BELIEF, THEY ARE TRUE, CORRECT, AND COMPLETE. DECLARATION OF PREPARER IS BASED ON ALL INFORMATION OF WHICH THE PREPARER

HAS ANY KNOWLEDGE.

SIGN

PREPARER’S SIGNATURE

DATE

EIN, SSN, OR PTIN

HERE

FIRM’S NAME (OR YOURS IF SELF-EMPLOYED)

CHECK IF SELF-EMPLOYED

PAID

PRE-

PARER

ADDRESS (STREET, CITY, STATE & ZIP CODE)

(Revised 12/10/14)

1

1 2

2