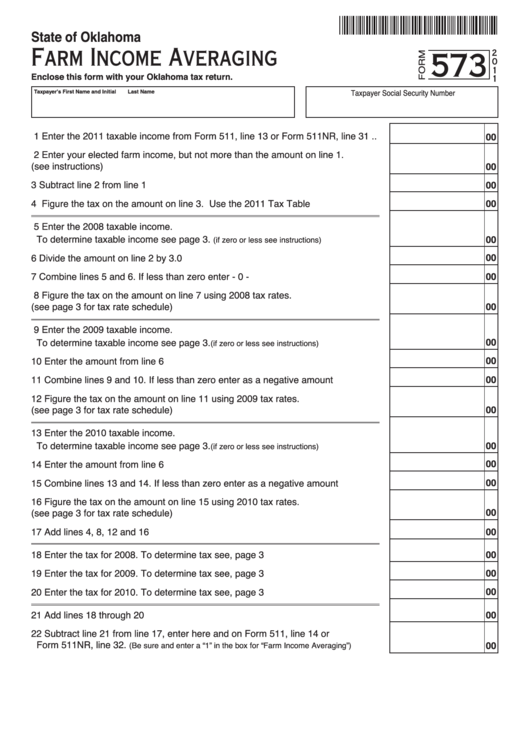

State of Oklahoma

Farm Income Averaging

573

2

0

1

Enclose this form with your Oklahoma tax return.

1

Taxpayer’s First Name and Initial

Last Name

Taxpayer Social Security Number

1 Enter the 2011 taxable income from Form 511, line 13 or Form 511NR, line 31 ..

00

2 Enter your elected farm income, but not more than the amount on line 1.

(see instructions) ..................................................................................................

00

3 Subtract line 2 from line 1 . ....................................................................................

00

4 Figure the tax on the amount on line 3. Use the 2011 Tax Table . .......................

00

5 Enter the 2008 taxable income.

To determine taxable income see page 3.

.................

00

(if zero or less see instructions)

6 Divide the amount on line 2 by 3.0 .......................................................................

00

7 Combine lines 5 and 6. If less than zero enter - 0 - . .............................................

00

8 Figure the tax on the amount on line 7 using 2008 tax rates.

(see page 3 for tax rate schedule) . .......................................................................

00

9 Enter the 2009 taxable income.

To determine taxable income see page 3.

.................

00

(if zero or less see instructions)

10 Enter the amount from line 6 ................................................................................

00

11 Combine lines 9 and 10. If less than zero enter as a negative amount . ...............

00

12 Figure the tax on the amount on line 11 using 2009 tax rates.

00

(see page 3 for tax rate schedule) . .......................................................................

13 Enter the 2010 taxable income.

.................

00

To determine taxable income see page 3.

(if zero or less see instructions)

00

14 Enter the amount from line 6 ................................................................................

15 Combine lines 13 and 14. If less than zero enter as a negative amount . .............

00

16 Figure the tax on the amount on line 15 using 2010 tax rates.

00

(see page 3 for tax rate schedule) . ......................................................................

00

17 Add lines 4, 8, 12 and 16 . .....................................................................................

18 Enter the tax for 2008. To determine tax see, page 3 . ..........................................

00

19 Enter the tax for 2009. To determine tax see, page 3 . ..........................................

00

20 Enter the tax for 2010. To determine tax see, page 3 . ..........................................

00

2 1 Add lines 18 through 20 . .......................................................................................

00

22 Subtract line 21 from line 17, enter here and on Form 511, line 14 or

Form 511NR, line 32.

. ......

00

(Be sure and enter a “1” in the box for “Farm Income Averaging”)

1

1 2

2 3

3