Form Sc Sch.tc-30 - Port Cargo Volume Increase Credit

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-30

DEPARTMENT OF REVENUE

PORT CARGO VOLUME

(Rev. 9/21/11)

INCREASE CREDIT

3419

20

Attach to your Income Tax Return

Names As Shown On Tax Return

SSN or FEIN

1.

$

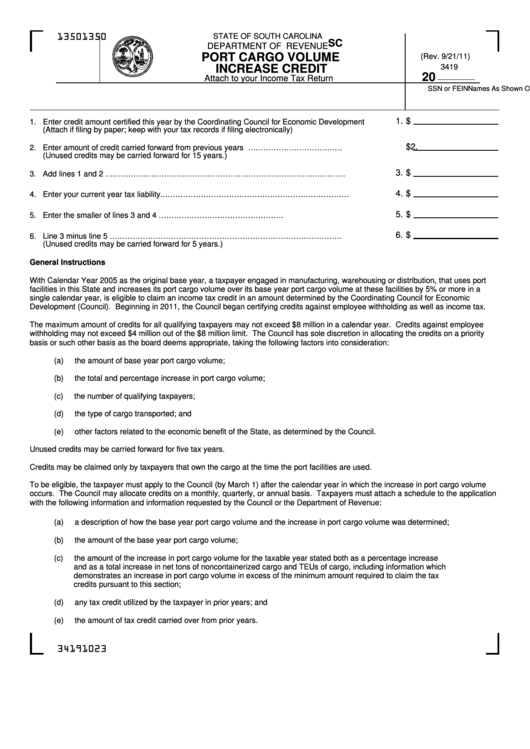

1. Enter credit amount certified this year by the Coordinating Council for Economic Development .........

(Attach if filing by paper; keep with your tax records if filing electronically)

2.

$

2. Enter amount of credit carried forward from previous years ....…………………………….….................

(Unused credits may be carried forward for 15 years.)

.

3.

$

3. Add lines 1 and 2 .…………………………………………………………………………………..................

4.

$

4. Enter your current year tax liability..………………………………………………………………................

5.

$

5. Enter the smaller of lines 3 and 4 .…………………………………………...............................................

6.

$

6. Line 3 minus line 5 .………………………………………………………………………………..................

(Unused credits may be carried forward for 5 years.)

General Instructions

With Calendar Year 2005 as the original base year, a taxpayer engaged in manufacturing, warehousing or distribution, that uses port

facilities in this State and increases its port cargo volume over its base year port cargo volume at these facilities by 5% or more in a

single calendar year, is eligible to claim an income tax credit in an amount determined by the Coordinating Council for Economic

Development (Council). Beginning in 2011, the Council began certifying credits against employee withholding as well as income tax.

The maximum amount of credits for all qualifying taxpayers may not exceed $8 million in a calendar year. Credits against employee

withholding may not exceed $4 million out of the $8 million limit. The Council has sole discretion in allocating the credits on a priority

basis or such other basis as the board deems appropriate, taking the following factors into consideration:

(a)

the amount of base year port cargo volume;

(b)

the total and percentage increase in port cargo volume;

(c)

the number of qualifying taxpayers;

(d)

the type of cargo transported; and

(e)

other factors related to the economic benefit of the State, as determined by the Council.

Unused credits may be carried forward for five tax years.

Credits may be claimed only by taxpayers that own the cargo at the time the port facilities are used.

To be eligible, the taxpayer must apply to the Council (by March 1) after the calendar year in which the increase in port cargo volume

occurs. The Council may allocate credits on a monthly, quarterly, or annual basis. Taxpayers must attach a schedule to the application

with the following information and information requested by the Council or the Department of Revenue:

(a)

a description of how the base year port cargo volume and the increase in port cargo volume was determined;

(b)

the amount of the base year port cargo volume;

(c)

the amount of the increase in port cargo volume for the taxable year stated both as a percentage increase

and as a total increase in net tons of noncontainerized cargo and TEUs of cargo, including information which

demonstrates an increase in port cargo volume in excess of the minimum amount required to claim the tax

credits pursuant to this section;

(d)

any tax credit utilized by the taxpayer in prior years; and

(e)

the amount of tax credit carried over from prior years.

34191023

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2