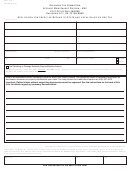

Instructions

Who Must File. Every county treasurer or designated county official must file this return for each tax period. This

return must be filed by the due date even if there was no sales or use tax collected for the tax period.

When and Where to File. This return is timely filed if postmarked on or before the 15th day of the month following

the tax period covered by the return. The return must be properly signed and accompanied by a check or money order

payable to the Nebraska Department of Revenue. Mail to the Nebraska Department of Revenue, PO Box 98923,

Lincoln, NE 68509-8923.

Preidentified Return. This return is for use by the county official whose name is printed on it. If a preidentified

return is not received for a tax period, a duplicate return should be requested from the Nebraska Department of Revenue

(Department). Do not file returns that are copies, returns for another tax period, or returns that have not been preidentified.

If the mailing address is incorrect, mark through the incorrect address and plainly print the correct address.

Penalty and Interest. A penalty for failing to file the return and paying the tax by the due date may be assessed.

Interest on the unpaid tax will be assessed at the statutory rate from the due date until payment is received.

Records. County officials who file this return must retain:

•

The white copies of Form 6MB in alphabetical order by month of registration; and

•

Forms 6XMB in alphabetical order by month of filing.

This should be done for a minimum of three years to verify the collection of sales and use tax.

Specific Instructions

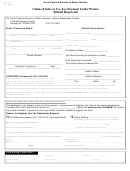

Line 1. Enter the total Nebraska sales and use tax collected on motorboats during the tax period.

Nebraska Schedule. Complete the Nebraska Schedule if local sales and use tax has been collected.

Line 2. Enter the total local sales and use tax collected from line 21, Nebraska Schedule.

Line 4. Enter the total amount of penalties collected during the tax period from Forms 6MB and Forms 6XMB.

Line 5. Enter the total amount of interest collected during the tax period from Forms 6MB and Forms 6XMB.

Line 9. A balance due or credit resulting from a partial payment, mathematical or clerical errors, penalty, or interest

relating to prior returns will be entered in this space by the Department. If the amount entered has been satisfied by a

previous payment, it should be disregarded when computing the amount to remit on line 10. A credit will be indicated

by the word “subtract” and can be subtracted from the amount due on line 10. The amount of “interest” in a balance

due will include interest assessed on unpaid tax through the due date of this return. If the amount due is paid before

the due date, the interest will be recomputed and a credit will be given on your next return.

Line 10. Electronic payments may be made using the Department’s free e-pay program (ACH Debit or ACH Credit),

credit card, or phone. Refer to the

EFT Debit User Guide

for additional information, or call 800-232-0057 to make a

payment.

Authorized Signature. This return must be signed by the county treasurer or designated county official, or other

person authorized to sign the return.

Nebraska Schedule

Lines 11 through 20. Enter the amount of local sales and use tax collected for each city or county.

Line 21. Enter the total local sales and use tax collected from lines 11 through 20.

11-2013

6-364-1996 Rev.

Supersedes 6-364-1996 Rev. 10-2012

1

1 2

2