Instructions For Rct-122 Return

ADVERTISEMENT

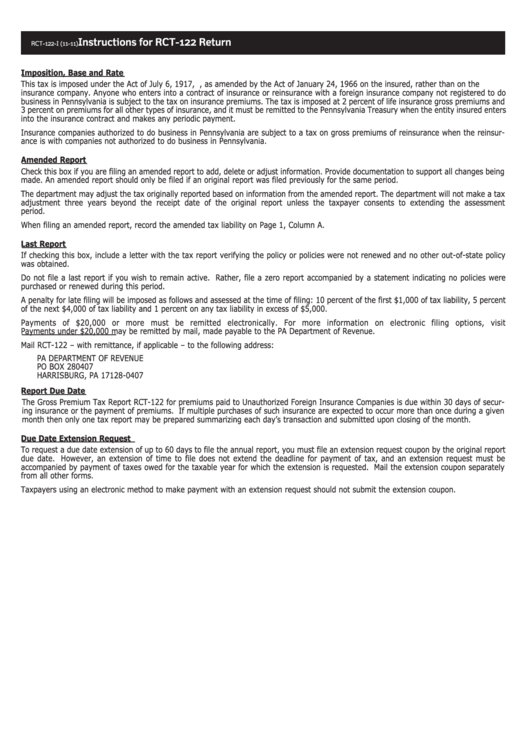

Instructions for RCT-122 Return

RCT-122-I (11-11)

Imposition, Base and Rate

This tax is imposed under the Act of July 6, 1917, P.L. 723, as amended by the Act of January 24, 1966 on the insured, rather than on the

insurance company. Anyone who enters into a contract of insurance or reinsurance with a foreign insurance company not registered to do

business in Pennsylvania is subject to the tax on insurance premiums. The tax is imposed at 2 percent of life insurance gross premiums and

3 percent on premiums for all other types of insurance, and it must be remitted to the Pennsylvania Treasury when the entity insured enters

into the insurance contract and makes any periodic payment.

Insurance companies authorized to do business in Pennsylvania are subject to a tax on gross premiums of reinsurance when the reinsur-

ance is with companies not authorized to do business in Pennsylvania.

Amended Report

Check this box if you are filing an amended report to add, delete or adjust information. Provide documentation to support all changes being

made. An amended report should only be filed if an original report was filed previously for the same period.

The department may adjust the tax originally reported based on information from the amended report. The department will not make a tax

adjustment three years beyond the receipt date of the original report unless the taxpayer consents to extending the assessment

period.

When filing an amended report, record the amended tax liability on Page 1, Column A.

Last Report

If checking this box, include a letter with the tax report verifying the policy or policies were not renewed and no other out-of-state policy

was obtained.

Do not file a last report if you wish to remain active. Rather, file a zero report accompanied by a statement indicating no policies were

purchased or renewed during this period.

A penalty for late filing will be imposed as follows and assessed at the time of filing: 10 percent of the first $1,000 of tax liability, 5 percent

of the next $4,000 of tax liability and 1 percent on any tax liability in excess of $5,000.

Payments of $20,000 or more must be remitted electronically. For more information on electronic filing options, visit

Payments under $20,000 may be remitted by mail, made payable to the PA Department of Revenue.

Mail RCT-122 – with remittance, if applicable – to the following address:

PA DEPARTMENT OF REVENUE

PO BOX 280407

HARRISBURG, PA 17128-0407

Report Due Date

The Gross Premium Tax Report RCT-122 for premiums paid to Unauthorized Foreign Insurance Companies is due within 30 days of secur-

ing insurance or the payment of premiums. If multiple purchases of such insurance are expected to occur more than once during a given

month then only one tax report may be prepared summarizing each day’s transaction and submitted upon closing of the month.

Due Date Extension Request

To request a due date extension of up to 60 days to file the annual report, you must file an extension request coupon by the original report

due date. However, an extension of time to file does not extend the deadline for payment of tax, and an extension request must be

accompanied by payment of taxes owed for the taxable year for which the extension is requested. Mail the extension coupon separately

from all other forms.

Taxpayers using an electronic method to make payment with an extension request should not submit the extension coupon.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2