Instructions For Form 221 - Underpayment Of Estimated Tax By Individuals - 2013

ADVERTISEMENT

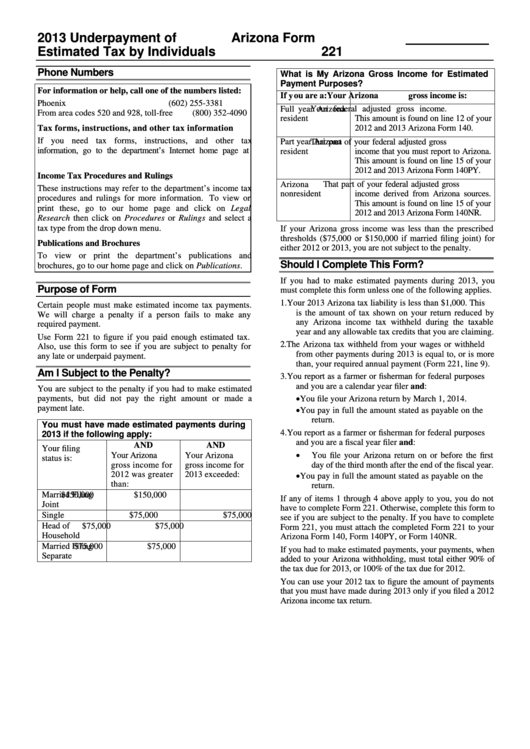

2013 Underpayment of

Arizona Form

Estimated Tax by Individuals

221

Phone Numbers

What is My Arizona Gross Income for Estimated

Payment Purposes?

For information or help, call one of the numbers listed:

If you are a:

Your Arizona gross income is:

Phoenix

(602) 255-3381

Full year Arizona

Your federal adjusted gross income.

From area codes 520 and 928, toll-free

(800) 352-4090

resident

This amount is found on line 12 of your

2012 and 2013 Arizona Form 140.

Tax forms, instructions, and other tax information

If you need tax forms, instructions, and other tax

Part year Arizona

That part of your federal adjusted gross

information, go to the department’s Internet home page at

resident

income that you must report to Arizona.

This amount is found on line 15 of your

2012 and 2013 Arizona Form 140PY.

Income Tax Procedures and Rulings

Arizona

That part of your federal adjusted gross

These instructions may refer to the department’s income tax

nonresident

income derived from Arizona sources.

procedures and rulings for more information. To view or

This amount is found on line 15 of your

print these, go to our home page and click on Legal

2012 and 2013 Arizona Form 140NR.

Research then click on Procedures or Rulings and select a

tax type from the drop down menu.

If your Arizona gross income was less than the prescribed

thresholds ($75,000 or $150,000 if married filing joint) for

Publications and Brochures

either 2012 or 2013, you are not subject to the penalty.

To view or print the department’s publications and

Should I Complete This Form?

brochures, go to our home page and click on Publications.

If you had to make estimated payments during 2013, you

Purpose of Form

must complete this form unless one of the following applies.

1. Your 2013 Arizona tax liability is less than $1,000. This

Certain people must make estimated income tax payments.

is the amount of tax shown on your return reduced by

We will charge a penalty if a person fails to make any

any Arizona income tax withheld during the taxable

required payment.

year and any allowable tax credits that you are claiming.

Use Form 221 to figure if you paid enough estimated tax.

2.

The Arizona tax withheld from your wages or withheld

Also, use this form to see if you are subject to penalty for

from other payments during 2013 is equal to, or is more

any late or underpaid payment.

than, your required annual payment (Form 221, line 9).

Am I Subject to the Penalty?

3. You report as a farmer or fisherman for federal purposes

and you are a calendar year filer and:

You are subject to the penalty if you had to make estimated

payments, but did not pay the right amount or made a

You file your Arizona return by March 1, 2014.

payment late.

You pay in full the amount stated as payable on the

return.

You must have made estimated payments during

4. You report as a farmer or fisherman for federal purposes

2013 if the following apply:

and you are a fiscal year filer and:

AND

AND

Your filing

Your Arizona

Your Arizona

You file your Arizona return on or before the first

status is:

gross income for

gross income for

day of the third month after the end of the fiscal year.

2012 was greater

2013 exceeded:

You pay in full the amount stated as payable on the

than:

return.

Married Filing

$150,000

$150,000

If any of items 1 through 4 above apply to you, you do not

Joint

have to complete Form 221. Otherwise, complete this form to

Single

$75,000

$75,000

see if you are subject to the penalty. If you have to complete

Head of

$75,000

$75,000

Form 221, you must attach the completed Form 221 to your

Household

Arizona Form 140, Form 140PY, or Form 140NR.

Married Filing

$75,000

$75,000

If you had to make estimated payments, your payments, when

Separate

added to your Arizona withholding, must total either 90% of

the tax due for 2013, or 100% of the tax due for 2012.

You can use your 2012 tax to figure the amount of payments

that you must have made during 2013 only if you filed a 2012

Arizona income tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5