Form Sc Sch.tc-21 - Credit For A Certified Historic Structure Placed In Service After June 30, 2003

ADVERTISEMENT

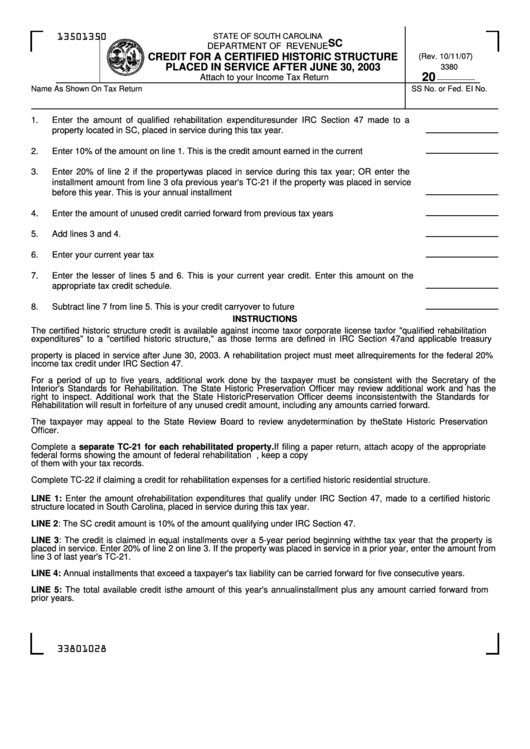

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-21

DEPARTMENT OF REVENUE

CREDIT FOR A CERTIFIED HISTORIC STRUCTURE

(Rev. 10/11/07)

PLACED IN SERVICE AFTER JUNE 30, 2003

3380

20

Attach to your Income Tax Return

Name As Shown On Tax Return

SS No. or Fed. EI No.

1.

Enter the amount of qualified rehabilitation expenditures under IRC Section 47 made to a

property located in SC, placed in service during this tax year. ..................................................

2.

Enter 10% of the amount on line 1. This is the credit amount earned in the current year............

3.

Enter 20% of line 2 if the property was placed in service during this tax year; OR enter the

installment amount from line 3 of a previous year's TC-21 if the property was placed in service

before this year. This is your annual installment amount.............................................................

4.

Enter the amount of unused credit carried forward from previous tax years ...............................

5.

Add lines 3 and 4. .......................................................................................................................

6.

Enter your current year tax liability...............................................................................................

7.

Enter the lesser of lines 5 and 6. This is your current year credit. Enter this amount on the

appropriate tax credit schedule. ..................................................................................................

8.

Subtract line 7 from line 5. This is your credit carryover to future years......................................

INSTRUCTIONS

The certified historic structure credit is available against income tax or corporate license tax for "qualified rehabilitation

expenditures" to a "certified historic structure," as those terms are defined in IRC Section 47 and applicable treasury

regulations. The credit is available if the expenditures are incurred in taxable years beginning after 2002 and if the

property is placed in service after June 30, 2003. A rehabilitation project must meet all requirements for the federal 20%

income tax credit under IRC Section 47.

For a period of up to five years, additional work done by the taxpayer must be consistent with the Secretary of the

Interior's Standards for Rehabilitation. The State Historic Preservation Officer may review additional work and has the

right to inspect. Additional work that the State Historic Preservation Officer deems inconsistent with the Standards for

Rehabilitation will result in forfeiture of any unused credit amount, including any amounts carried forward.

The taxpayer may appeal to the State Review Board to review any determination by the State Historic Preservation

Officer.

Complete a separate TC-21 for each rehabilitated property. If filing a paper return, attach a copy of the appropriate

federal forms showing the amount of federal rehabilitation expenditures claimed. If filing an electronic return, keep a copy

of them with your tax records.

Complete TC-22 if claiming a credit for rehabilitation expenses for a certified historic residential structure.

LINE 1: Enter the amount of rehabilitation expenditures that qualify under IRC Section 47, made to a certified historic

structure located in South Carolina, placed in service during this tax year.

LINE 2: The SC credit amount is 10% of the amount qualifying under IRC Section 47.

LINE 3: The credit is claimed in equal installments over a 5-year period beginning with the tax year that the property is

placed in service. Enter 20% of line 2 on line 3. If the property was placed in service in a prior year, enter the amount from

line 3 of last year's TC-21.

LINE 4: Annual installments that exceed a taxpayer's tax liability can be carried forward for five consecutive years.

LINE 5: The total available credit is the amount of this year's annual installment plus any amount carried forward from

prior years.

33801028

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2