Form Sc Sch.tc-20 - Credit For Expenses Incurred Through Brownfields Volu

ADVERTISEMENT

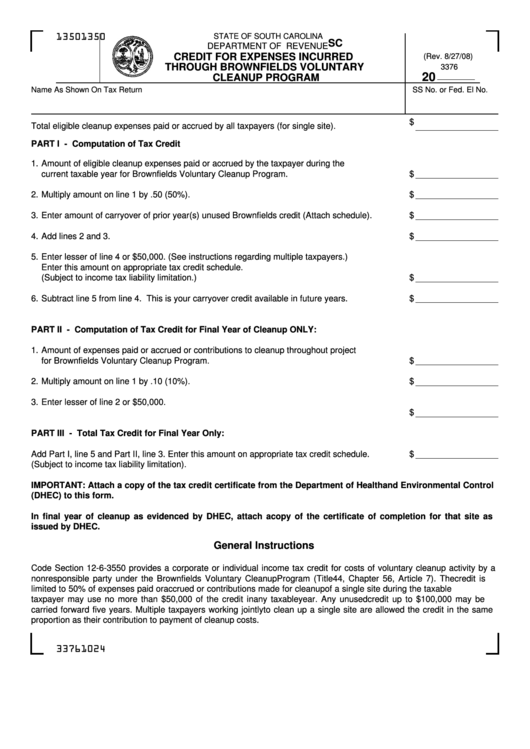

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-20

DEPARTMENT OF REVENUE

CREDIT FOR EXPENSES INCURRED

(Rev. 8/27/08)

THROUGH BROWNFIELDS VOLUNTARY

3376

20

CLEANUP PROGRAM

Name As Shown On Tax Return

SS No. or Fed. El No.

$

Total eligible cleanup expenses paid or accrued by all taxpayers (for single site).

PART I - Computation of Tax Credit

1.

Amount of eligible cleanup expenses paid or accrued by the taxpayer during the

current taxable year for Brownfields Voluntary Cleanup Program.

$

2.

Multiply amount on line 1 by .50 (50%).

$

3.

Enter amount of carryover of prior year(s) unused Brownfields credit (Attach schedule).

$

4.

Add lines 2 and 3.

$

5.

Enter lesser of line 4 or $50,000. (See instructions regarding multiple taxpayers.)

Enter this amount on appropriate tax credit schedule.

(Subject to income tax liability limitation.)

$

6.

Subtract line 5 from line 4. This is your carryover credit available in future years.

$

PART II - Computation of Tax Credit for Final Year of Cleanup ONLY:

1.

Amount of expenses paid or accrued or contributions to cleanup throughout project

for Brownfields Voluntary Cleanup Program.

$

2.

Multiply amount on line 1 by .10 (10%).

$

3.

Enter lesser of line 2 or $50,000.

$

PART III - Total Tax Credit for Final Year Only:

Add Part I, line 5 and Part II, line 3. Enter this amount on appropriate tax credit schedule.

$

(Subject to income tax liability limitation).

IMPORTANT: Attach a copy of the tax credit certificate from the Department of Health and Environmental Control

(DHEC) to this form.

In final year of cleanup as evidenced by DHEC, attach a copy of the certificate of completion for that site as

issued by DHEC.

General Instructions

Code Section 12-6-3550 provides a corporate or individual income tax credit for costs of voluntary cleanup activity by a

nonresponsible party under the Brownfields Voluntary Cleanup Program (Title 44, Chapter 56, Article 7). The credit is

limited to 50% of expenses paid or accrued or contributions made for cleanup of a single site during the taxable year. The

taxpayer may use no more than $50,000 of the credit in any taxable year. Any unused credit up to $100,000 may be

carried forward five years. Multiple taxpayers working jointly to clean up a single site are allowed the credit in the same

proportion as their contribution to payment of cleanup costs.

33761024

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2