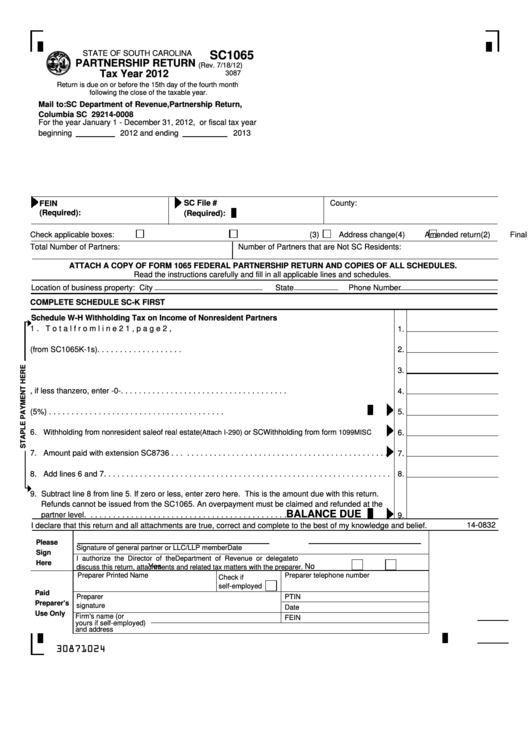

STATE OF SOUTH CAROLINA

SC1065

PARTNERSHIP RETURN

(Rev. 7/18/12)

Tax Year 2012

3087

Return is due on or before the 15th day of the fourth month

following the close of the taxable year.

Mail to: SC Department of Revenue, Partnership Return,

Columbia SC 29214-0008

For the year January 1 - December 31, 2012, or fiscal tax year

beginning

2012 and ending

2013

SC File #

County:

FEIN

(Required):

(Required):

Check applicable boxes:

(1)

Initial return

(2)

Final return

(3)

Address change

(4)

Amended return

Total Number of Partners:

Number of Partners that are Not SC Residents:

ATTACH A COPY OF FORM 1065 FEDERAL PARTNERSHIP RETURN AND COPIES OF ALL SCHEDULES.

Read the instructions carefully and fill in all applicable lines and schedules.

Location of business property: City

State

Phone Number

COMPLETE SCHEDULE SC-K FIRST

Schedule W-H Withholding Tax on Income of Nonresident Partners

1. Total from line 21, page 2, SC1065. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2. Amount of line 1 income taxable to nonresident partners (from SC1065 K-1s). . . . . . . . . . . . . . . . . . .

2.

3. Amount of line 2 exempt from withholding because of I-309 affidavit or composite filing . . . . . . . . . . .

3.

4. Subtract line 3 from line 2, if less than zero, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Withholding tax due - line 4 times .05 (5%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Withholding from nonresident sale of real estate

or SC Withholding from form

6.

(Attach I-290)

1099MISC

7. Amount paid with extension SC8736 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Add lines 6 and 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Subtract line 8 from line 5. If zero or less, enter zero here. This is the amount due with this return.

Refunds cannot be issued from the SC1065. An overpayment must be claimed and refunded at the

BALANCE DUE

partner level. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

I declare that this return and all attachments are true, correct and complete to the best of my knowledge and belief.

14-0832

Please

Signature of general partner or LLC/LLP member

Date

Sign

I authorize the Director of the Department of Revenue or delegate to

Here

Yes

No

discuss this return, attachments and related tax matters with the preparer.

Preparer Printed Name

Preparer telephone number

Check if

self-employed

Paid

Preparer

PTIN

Preparer's

signature

Date

Use Only

Firm's name (or

FEIN

yours if self-employed)

and address

30871024

1

1 2

2 3

3 4

4 5

5 6

6 7

7