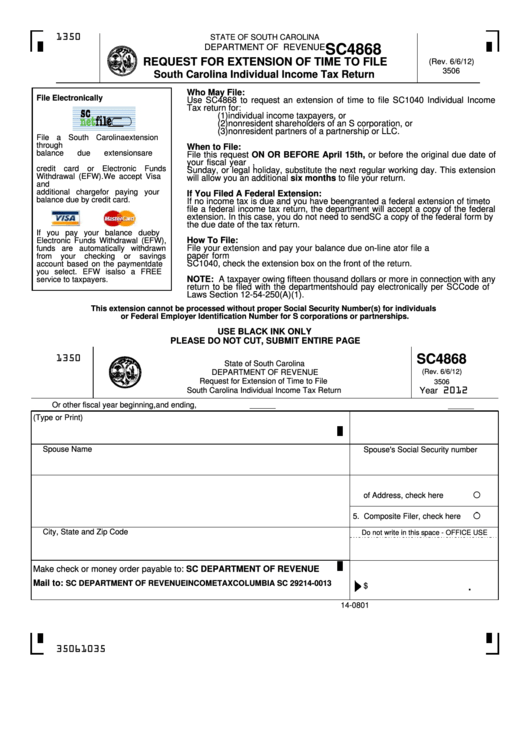

1350

STATE OF SOUTH CAROLINA

SC4868

DEPARTMENT OF REVENUE

REQUEST FOR EXTENSION OF TIME TO FILE

(Rev. 6/6/12)

3506

South Carolina Individual Income Tax Return

Who May File:

File Electronically

Use SC4868 to request an extension of time to file SC1040 Individual Income

Tax return for:

(1)

individual income taxpayers, or

(2)

nonresident shareholders of an S corporation, or

(3)

nonresident partners of a partnership or LLC.

File a South Carolina extension

through

SCnetFile.

Zero

and

When to File:

balance

due

extensions

are

File this request ON OR BEFORE April 15th, or before the original due date of

accepted. Pay any balance due by

your fiscal year return. If the due date for filing your return falls on a Saturday,

credit

card

or

Electronic

Funds

Sunday, or legal holiday, substitute the next regular working day. This extension

Withdrawal (EFW). We accept Visa

will allow you an additional six months to file your return.

and

MasterCard.

There

is

no

additional charge for paying your

If You Filed A Federal Extension:

balance due by credit card.

If no income tax is due and you have been granted a federal extension of time to

file a federal income tax return, the department will accept a copy of the federal

extension. In this case, you do not need to send SC a copy of the federal form by

the due date of the tax return.

If you pay your balance due by

How To File:

Electronic Funds Withdrawal (EFW),

File your extension and pay your balance due on-line at or file a

funds are automatically withdrawn

paper form SC4868. Mail the original with payment if any. When you file your

from

your

checking

or

savings

SC1040, check the extension box on the front of the return.

account based on the payment date

you select. EFW is also a FREE

NOTE: A taxpayer owing fifteen thousand dollars or more in connection with any

service to taxpayers.

return to be filed with the department should pay electronically per SC Code of

Laws Section 12-54-250(A)(1).

This extension cannot be processed without proper Social Security Number(s) for individuals

or Federal Employer Identification Number for S corporations or partnerships.

USE BLACK INK ONLY

PLEASE DO NOT CUT, SUBMIT ENTIRE PAGE

SC4868

1350

State of South Carolina

DEPARTMENT OF REVENUE

(Rev. 6/6/12)

Request for Extension of Time to File

3506

South Carolina Individual Income Tax Return

Year 2012

Or other fiscal year beginning

,

and ending

,

3. Your Social Security number/FEIN

1. Your Name (Type or Print)

Spouse Name

Spouse's Social Security number

2. Home Address

4. New Filer or Change

of Address, check here

5. Composite Filer, check here

City, State and Zip Code

Do not write in this space - OFFICE USE

6. Balance Due from Worksheet

Make check or money order payable to: SC DEPARTMENT OF REVENUE

Mail to:

SC DEPARTMENT OF REVENUE INCOME TAX COLUMBIA SC 29214-0013

$

.

14-0801

35061035

1

1 2

2