Form Sc Sch.tc-18 - Research Expenses Credit

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-18

DEPARTMENT OF REVENUE

(Rev. 6/26/09)

RESEARCH EXPENSES CREDIT

3368

Attach to your Income Tax Return

20

Name As Shown On Tax Return

SS No. or Fed. EI No.

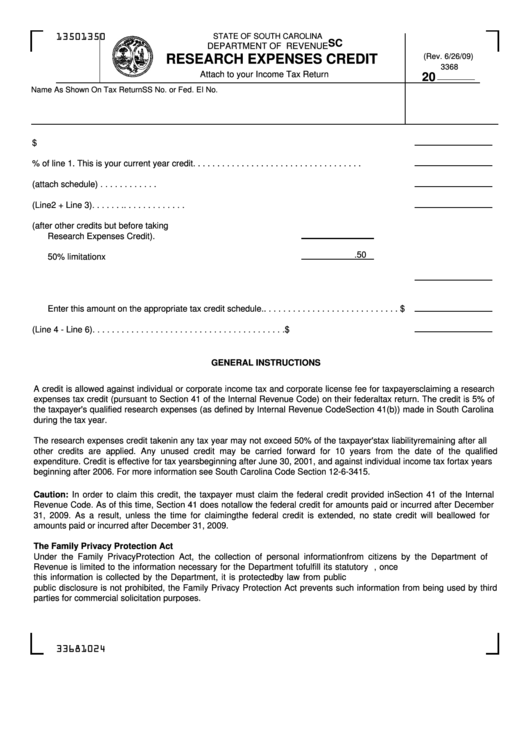

1. Qualified research expenses made in South Carolina. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

2. Enter 5% of line 1. This is your current year credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Research Expenses Credit carry-overs from previous years (attach schedule) . . . . . . . . . . . .

4. Total Research Expenses Credit before limitations (Line 2 + Line 3). . . . . . . . . . . . . . . . . . . .

5. Remaining Tax Liability (after other credits but before taking

Research Expenses Credit).

.50

50% limitation

x

Research Expenses Credit Limitation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Enter the lesser of line 4 or line 5. This is your allowable Research Expenses Credit.

Enter this amount on the appropriate tax credit schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

7. Carry-over to future years (Line 4 - Line 6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

GENERAL INSTRUCTIONS

A credit is allowed against individual or corporate income tax and corporate license fee for taxpayers claiming a research

expenses tax credit (pursuant to Section 41 of the Internal Revenue Code) on their federal tax return. The credit is 5% of

the taxpayer's qualified research expenses (as defined by Internal Revenue Code Section 41(b)) made in South Carolina

during the tax year.

The research expenses credit taken in any tax year may not exceed 50% of the taxpayer's tax liability remaining after all

other credits are applied. Any unused credit may be carried forward for 10 years from the date of the qualified

expenditure. Credit is effective for tax years beginning after June 30, 2001, and against individual income tax for tax years

beginning after 2006. For more information see South Carolina Code Section 12-6-3415.

Caution: In order to claim this credit, the taxpayer must claim the federal credit provided in Section 41 of the Internal

Revenue Code. As of this time, Section 41 does not allow the federal credit for amounts paid or incurred after December

31, 2009. As a result, unless the time for claiming the federal credit is extended, no state credit will be allowed for

amounts paid or incurred after December 31, 2009.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of

Revenue is limited to the information necessary for the Department to fulfill its statutory duties. In most instances, once

this information is collected by the Department, it is protected by law from public disclosure. In those situations where

public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third

parties for commercial solicitation purposes.

33681024

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1