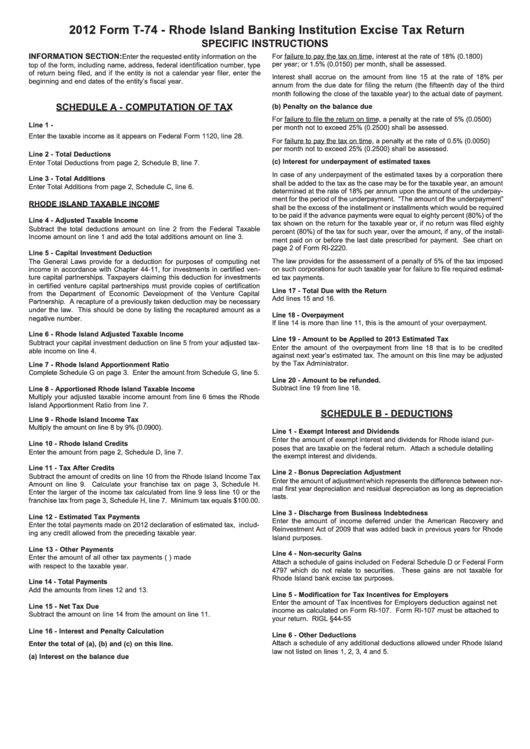

Form T-74 - Rhode Island Banking Institution Excise Tax Return Specific Instructions - 2012

ADVERTISEMENT

2012 Form T-74 - Rhode Island Banking Institution Excise Tax Return

SPECIFIC INSTRUCTIONS

INFORMATION SECTION:

For failure to pay the tax on time, interest at the rate of 18% (0.1800)

Enter the requested entity information on the

per year; or 1.5% (0.0150) per month, shall be assessed.

top of the form, including name, address, federal identification number, type

of return being filed, and if the entity is not a calendar year filer, enter the

Interest shall accrue on the amount from line 15 at the rate of 18% per

beginning and end dates of the entity’s fiscal year.

annum from the due date for filing the return (the fifteenth day of the third

month following the close of the taxable year) to the actual date of payment.

SCHEDULE A - COMPUTATION OF TAX

(b) Penalty on the balance due

For failure to file the return on time, a penalty at the rate of 5% (0.0500)

Line 1 -

per month not to exceed 25% (0.2500) shall be assessed.

Enter the taxable income as it appears on Federal Form 1120, line 28.

For failure to pay the tax on time, a penalty at the rate of 0.5% (0.0050)

per month not to exceed 25% (0.2500) shall be assessed.

Line 2 - Total Deductions

(c) Interest for underpayment of estimated taxes

Enter Total Deductions from page 2, Schedule B, line 7.

In case of any underpayment of the estimated taxes by a corporation there

Line 3 - Total Additions

shall be added to the tax as the case may be for the taxable year, an amount

Enter Total Additions from page 2, Schedule C, line 6.

determined at the rate of 18% per annum upon the amount of the underpay-

ment for the period of the underpayment. “The amount of the underpayment”

RHODE ISLAND TAXABLE INCOME

shall be the excess of the installment or installments which would be required

to be paid if the advance payments were equal to eighty percent (80%) of the

Line 4 - Adjusted Taxable Income

tax shown on the return for the taxable year or, if no return was filed eighty

Subtract the total deductions amount on line 2 from the Federal Taxable

percent (80%) of the tax for such year, over the amount, if any, of the install-

Income amount on line 1 and add the total additions amount on line 3.

ment paid on or before the last date prescribed for payment. See chart on

page 2 of Form RI-2220.

Line 5 - Capital Investment Deduction

The law provides for the assessment of a penalty of 5% of the tax imposed

The General Laws provide for a deduction for purposes of computing net

income in accordance with Chapter 44-11, for investments in certified ven-

on such corporations for such taxable year for failure to file required estimat-

ture capital partnerships. Taxpayers claiming this deduction for investments

ed tax payments.

in certified venture capital partnerships must provide copies of certification

Line 17 - Total Due with the Return

from the Department of Economic Development of the Venture Capital

Add lines 15 and 16.

Partnership. A recapture of a previously taken deduction may be necessary

under the law. This should be done by listing the recaptured amount as a

Line 18 - Overpayment

negative number.

If line 14 is more than line 11, this is the amount of your overpayment.

Line 6 - Rhode Island Adjusted Taxable Income

Line 19 - Amount to be Applied to 2013 Estimated Tax

Subtract your capital investment deduction on line 5 from your adjusted tax-

Enter the amount of the overpayment from line 18 that is to be credited

able income on line 4.

against next year’s estimated tax. The amount on this line may be adjusted

by the Tax Administrator.

Line 7 - Rhode Island Apportionment Ratio

Complete Schedule G on page 3. Enter the amount from Schedule G, line 5.

Line 20 - Amount to be refunded.

Subtract line 19 from line 18.

Line 8 - Apportioned Rhode Island Taxable Income

Multiply your adjusted taxable income amount from line 6 times the Rhode

Island Apportionment Ratio from line 7.

SCHEDULE B - DEDUCTIONS

Line 9 - Rhode Island Income Tax

Multiply the amount on line 8 by 9% (0.0900).

Line 1 - Exempt Interest and Dividends

Enter the amount of exempt interest and dividends for Rhode island pur-

Line 10 - Rhode Island Credits

poses that are taxable on the federal return. Attach a schedule detailing

Enter the amount from page 2, Schedule D, line 7.

the exempt interest and dividends.

Line 11 - Tax After Credits

Line 2 - Bonus Depreciation Adjustment

Subtract the amount of credits on line 10 from the Rhode Island Income Tax

Enter the amount of adjustment which represents the difference between nor-

Amount on line 9. Calculate your franchise tax on page 3, Schedule H.

mal first year depreciation and residual depreciation as long as depreciation

Enter the larger of the income tax calculated from line 9 less line 10 or the

lasts.

franchise tax from page 3, Schedule H, line 7. Minimum tax equals $100.00.

Line 3 - Discharge from Business Indebtedness

Line 12 - Estimated Tax Payments

Enter the amount of income deferred under the American Recovery and

Enter the total payments made on 2012 declaration of estimated tax, includ-

Reinvestment Act of 2009 that was added back in previous years for Rhode

ing any credit allowed from the preceding taxable year.

Island purposes.

Line 13 - Other Payments

Line 4 - Non-security Gains

Enter the amount of all other tax payments (i.e. extension payment) made

Attach a schedule of gains included on Federal Schedule D or Federal Form

with respect to the taxable year.

4797 which do not relate to securities. These gains are not taxable for

Rhode Island bank excise tax purposes.

Line 14 - Total Payments

Add the amounts from lines 12 and 13.

Line 5 - Modification for Tax Incentives for Employers

Enter the amount of Tax Incentives for Employers deduction against net

Line 15 - Net Tax Due

income as calculated on Form RI-107. Form RI-107 must be attached to

Subtract the amount on line 14 from the amount on line 11.

your return. RIGL §44-55

Line 16 - Interest and Penalty Calculation

Line 6 - Other Deductions

Attach a schedule of any additional deductions allowed under Rhode Island

Enter the total of (a), (b) and (c) on this line.

law not listed on lines 1, 2, 3, 4 and 5.

(a) Interest on the balance due

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3