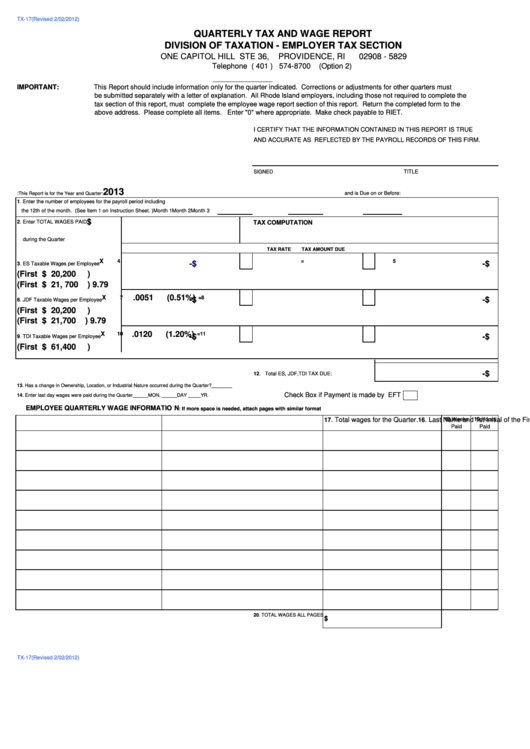

TX-17(Revised 2/02/2012)

QUARTERLY TAX AND WAGE REPORT

DIVISION OF TAXATION - EMPLOYER TAX SECTION

ONE CAPITOL HILL STE 36,

PROVIDENCE, RI

02908 - 5829

Telephone ( 401 ) 574-8700

(Option 2)

IMPORTANT:

This Report should include information only for the quarter indicated. Corrections or adjustments for other quarters must

be submitted separately with a letter of explanation. All Rhode Island employers, including those not required to complete the

tax section of this report, must complete the employee wage report section of this report. Return the completed form to the

above address. Please complete all items. Enter "0" where appropriate. Make check payable to RIET.

I CERTIFY THAT THE INFORMATION CONTAINED IN THIS REPORT IS TRUE

AND ACCURATE AS REFLECTED BY THE PAYROLL RECORDS OF THIS FIRM.

SIGNED

TITLE

2013

R.I. Employer Account Number:

and is Due on or Before:

This Report is for the Year and Quarter:

1. Enter the number of employees for the payroll period including

the 12th of the month. (See Item 1 on Instruction Sheet. )

Month 1

Month 2

Month 3

$

2. Enter TOTAL WAGES PAID

TAX COMPUTATION

during the Quarter

TAX RATE

TAX AMOUNT DUE

X

4

=

5

$

-

$

-

3. ES Taxable Wages per Employee

(First $ 20,200

)

(First $ 21, 700

) 9.79

.0051

(0.51%)

X

7

=

8

$

-

$

-

6. JDF Taxable Wages per Employee

(First $ 20,200

)

(First $ 21,700

) 9.79

.0120

(1.20%)

X

10

=

11

$

-

$

-

9. TDI Taxable Wages per Employee

(First $ 61,400

)

$

-

12. Total ES, JDF,TDI TAX DUE:

13. Has a change in Ownership, Location, or Industrial Nature occurred during the Quarter?________

Check Box if Payment is made by EFT

14. Enter last day wages were paid during the Quarter______MON. ______DAY _____YR.

EMPLOYEE QUARTERLY WAGE INFORMATION

: If more space is needed, attach pages with similar format

. Social Security Number

. Last Name and 1st Initial of the First Name

. Total wages for the Quarter.

15

16

17

18.Weeks

19.Hours

Paid

Paid

20. TOTAL WAGES ALL PAGES

$

TX-17(Revised 2/02/2012)

1

1 2

2