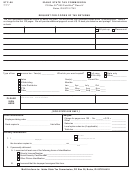

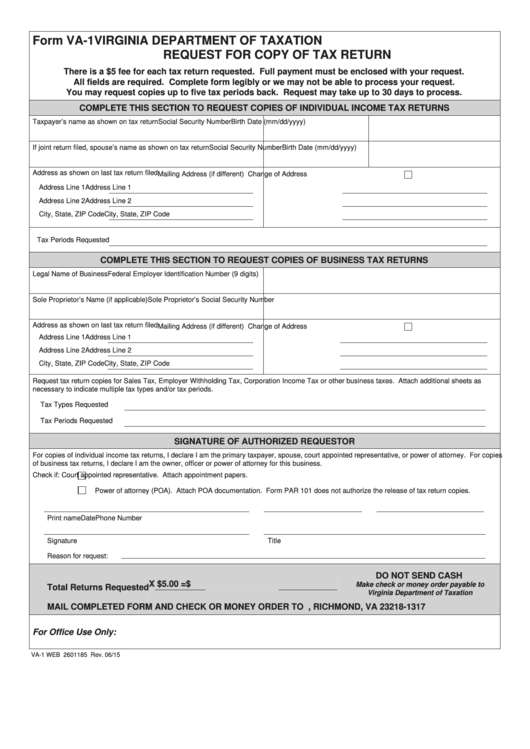

Form VA-1

VIRGINIA DEPARTMENT OF TAXATION

REQUEST FOR COPY OF TAX RETURN

There is a $5 fee for each tax return requested. Full payment must be enclosed with your request.

All fields are required. Complete form legibly or we may not be able to process your request.

You may request copies up to five tax periods back. Request may take up to 30 days to process.

COMPLETE THIS SECTION TO REQUEST COPIES OF INDIVIDUAL INCOME TAX RETURNS

Taxpayer’s name as shown on tax return

Social Security Number

Birth Date (mm/dd/yyyy)

If joint return filed, spouse’s name as shown on tax return

Social Security Number

Birth Date (mm/dd/yyyy)

Address as shown on last tax return filed

Mailing Address (if different)

Change of Address

Address Line 1

Address Line 1

Address Line 2

Address Line 2

City, State, ZIP Code

City, State, ZIP Code

Tax Periods Requested

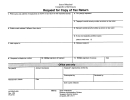

COMPLETE THIS SECTION TO REQUEST COPIES OF BUSINESS TAX RETURNS

Legal Name of Business

Federal Employer Identification Number (9 digits)

Sole Proprietor’s Name (if applicable)

Sole Proprietor’s Social Security Number

Address as shown on last tax return filed

Mailing Address (if different)

Change of Address

Address Line 1

Address Line 1

Address Line 2

Address Line 2

City, State, ZIP Code

City, State, ZIP Code

Request tax return copies for Sales Tax, Employer Withholding Tax, Corporation Income Tax or other business taxes. Attach additional sheets as

necessary to indicate multiple tax types and/or tax periods.

Tax Types Requested

Tax Periods Requested

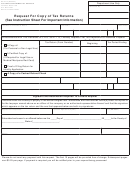

SIGNATURE OF AUTHORIZED REQUESTOR

For copies of individual income tax returns, I declare I am the primary taxpayer, spouse, court appointed representative, or power of attorney. For copies

of business tax returns, I declare I am the owner, officer or power of attorney for this business.

Check if:

Court appointed representative. Attach appointment papers.

Power of attorney (POA). Attach POA documentation. Form PAR 101 does not authorize the release of tax return copies.

Print name

Date

Phone Number

Signature

Title

Reason for request:

DO NOT SEND CASH

X $5.00 =

$

Make check or money order payable to

Total Returns Requested

Virginia Department of Taxation

MAIL COMPLETED FORM AND CHECK OR MONEY ORDER TO P.O. BOX 1317, RICHMOND, VA 23218-1317

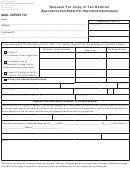

For Office Use Only:

VA-1 WEB 2601185 Rev. 06/15

1

1