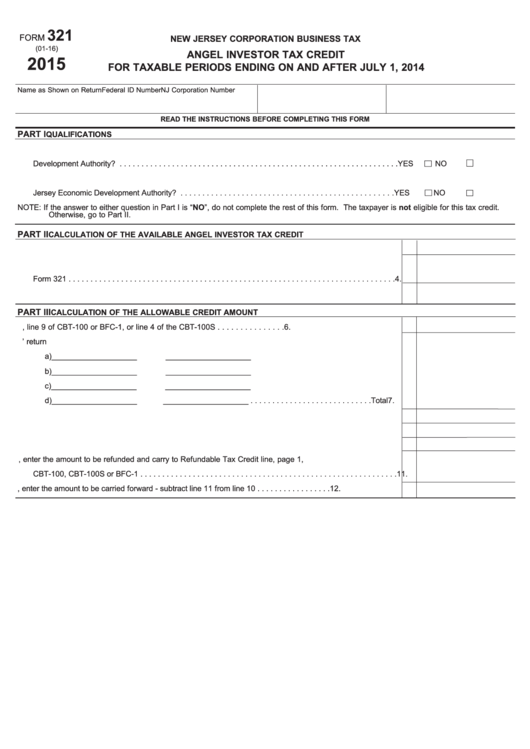

321

NEW JERSEY CORPORATION BUSINESS TAX

FORM

(01-16)

ANGEL INVESTOR TAX CREDIT

2015

FOR TAXABLE PERIODS ENDING ON AND AFTER JULY 1, 2014

Name as Shown on Return

Federal ID Number

NJ Corporation Number

READ THE INSTRUCTIONS BEFORE COMPLETING THIS FORM

PART I

QUALIFICATIONS

1. Does the taxpayer have an approval letter issued by the New Jersey Economic

Development Authority? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

2. Has the taxpayer received and attached the original tax credit certificate issued by the New

Jersey Economic Development Authority? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

If the answer to either question in Part I is “NO”, do not complete the rest of this form. The taxpayer is not eligible for this tax credit.

NOTE:

Otherwise, go to Part II.

PART II

CALCULATION OF THE AVAILABLE ANGEL INVESTOR TAX CREDIT

3. Enter the approved credit amount as reported on the attached certificate . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Enter the amount of credit carry forward from the prior tax period - from line 12 of the prior tax period

Form 321 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Total tax credit available - add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

PART III

CALCULATION OF THE ALLOWABLE CREDIT AMOUNT

6. Enter tax liability from page 1, line 9 of CBT-100 or BFC-1, or line 4 of the CBT-100S . . . . . . . . . . . . . . .

6.

7. Total tax credits taken on current years’ return

a)____________________

____________________

b)____________________

____________________

c)____________________

____________________

d)____________________

____________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . .Total

7.

8. Remaining tax liablilty after other credits - subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Enter lesser of line 5 or line 8 here - carry to Angel Investor Tax Credit line on Schedule A-3 . . . . . . . . . .

9.

10. If line 5 is greater than line 8 - enter the difference here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

11. From line 10, enter the amount to be refunded and carry to Refundable Tax Credit line, page 1,

CBT-100, CBT-100S or BFC-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

12. From line 10, enter the amount to be carried forward - subtract line 11 from line 10 . . . . . . . . . . . . . . . . .

12.

1

1 2

2