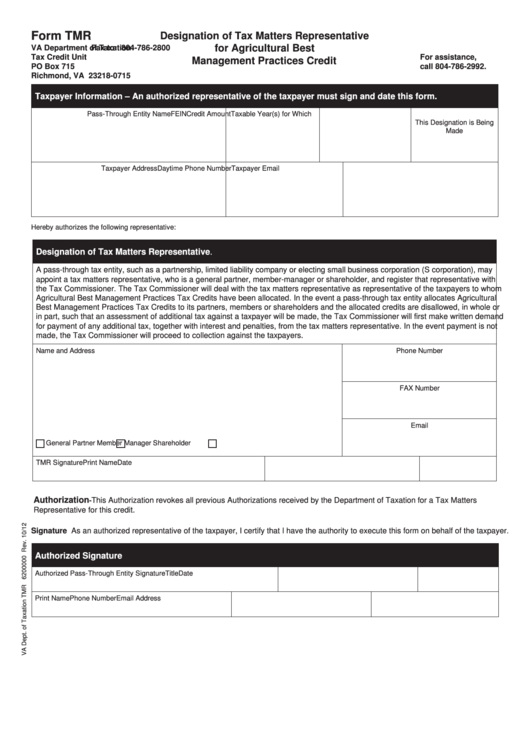

Form TMR

Designation of Tax Matters Representative

for Agricultural Best

VA Department of Taxation

Fax to: 804-786-2800

Tax Credit Unit

For assistance,

Management Practices Credit

PO Box 715

call 804-786-2992.

Richmond, VA 23218-0715

Taxpayer Information – An authorized representative of the taxpayer must sign and date this form.

Pass-Through Entity Name

FEIN

Credit Amount

Taxable Year(s) for Which

This Designation is Being

Made

Taxpayer Address

Daytime Phone Number

Taxpayer Email

Hereby authorizes the following representative:

Designation of Tax Matters Representative.

A pass-through tax entity, such as a partnership, limited liability company or electing small business corporation (S corporation), may

appoint a tax matters representative, who is a general partner, member-manager or shareholder, and register that representative with

the Tax Commissioner. The Tax Commissioner will deal with the tax matters representative as representative of the taxpayers to whom

Agricultural Best Management Practices Tax Credits have been allocated. In the event a pass-through tax entity allocates Agricultural

Best Management Practices Tax Credits to its partners, members or shareholders and the allocated credits are disallowed, in whole or

in part, such that an assessment of additional tax against a taxpayer will be made, the Tax Commissioner will first make written demand

for payment of any additional tax, together with interest and penalties, from the tax matters representative. In the event payment is not

made, the Tax Commissioner will proceed to collection against the taxpayers.

Name and Address

Phone Number

FAX Number

Email

General Partner

Member Manager

Shareholder

TMR Signature

Print Name

Date

Authorization

This Authorization revokes all previous Authorizations received by the Department of Taxation for a Tax Matters

-

Representative for this credit.

Signature As an authorized representative of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer.

Authorized Signature

Authorized Pass-Through Entity Signature

Title

Date

Print Name

Phone Number

Email Address

1

1