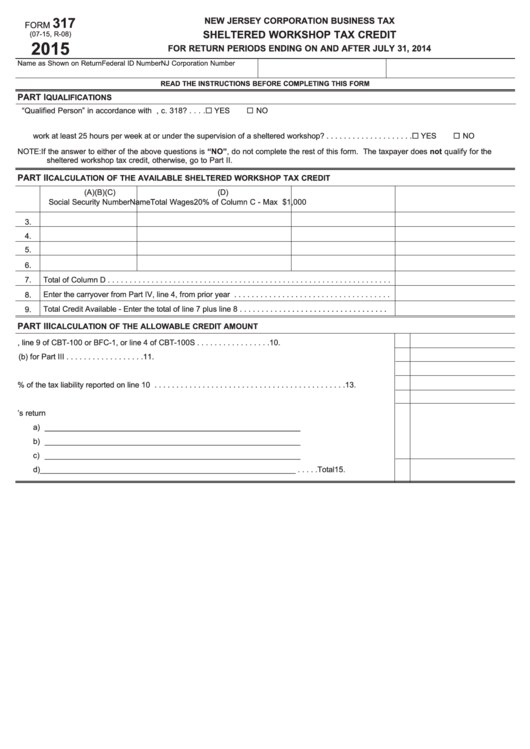

317

NEW JERSEY CORPORATION BUSINESS TAX

FORM

SHELTERED WORKSHOP TAX CREDIT

(07-15, R-08)

2015

FOR RETURN PERIODS ENDING ON AND AFTER JULY 31, 2014

Name as Shown on Return

Federal ID Number

NJ Corporation Number

READ THE INSTRUCTIONS BEFORE COMPLETING THIS FORM

PART I

QUALIFICATIONS

1. Is each employee for which a credit is claimed a “Qualified Person” in accordance with P.L. 2005, c. 318? . . . . ¨ YES

¨ NO

2. Did each employee for which a credit is claimed work for at least 26 weeks during the privilege period and

work at least 25 hours per week at or under the supervision of a sheltered workshop? . . . . . . . . . . . . . . . . . . . . ¨ YES

¨ NO

NOTE: If the answer to either of the above questions is “NO”, do not complete the rest of this form. The taxpayer does not qualify for the

sheltered workshop tax credit, otherwise, go to Part II.

PART II

CALCULATION OF THE AVAILABLE SHELTERED WORKSHOP TAX CREDIT

(A)

(B)

(C)

(D)

Social Security Number

Name

Total Wages

20% of Column C - Max $1,000

3.

4.

5.

6.

Total of Column D . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8.

Enter the carryover from Part IV, line 4, from prior year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Credit Available - Enter the total of line 7 plus line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

PART III

CALCULATION OF THE ALLOWABLE CREDIT AMOUNT

10. Enter tax liability from page 1, line 9 of CBT-100 or BFC-1, or line 4 of CBT-100S . . . . . . . . . . . . . . . . . 10.

11. Enter the required minimum tax liability as indicated in instruction (b) for Part III . . . . . . . . . . . . . . . . . . 11.

12. Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Enter 50% of the tax liability reported on line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

14. Enter the lesser of line 12 or line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

15. Tax Credits taken on current year’s return

a) ______________________________

______________________________

b) ______________________________

______________________________

c) ______________________________

______________________________

d) ______________________________

______________________________ . . . . .Total 15.

1

1 2

2 3

3