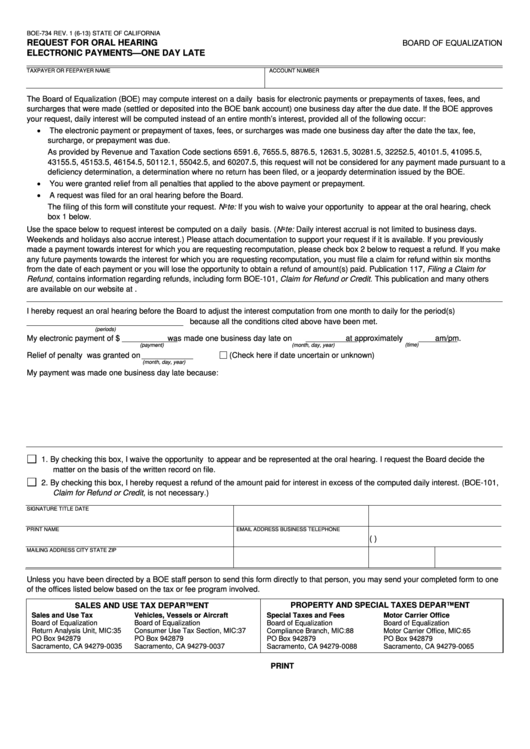

BOE-734 REV. 1 (6-13)

STATE OF CALIFORNIA

REQUEST FOR ORAL HEARING

BOARD OF EQUALIZATION

ELECTRONIC PAYMENTS—ONE DAY LATE

TAXPAYER OR FEEPAYER NAME

ACCOUNT NUMBER

The Board of Equalization (BOE) may compute interest on a daily basis for electronic payments or prepayments of taxes, fees, and

surcharges that were made (settled or deposited into the BOE bank account) one business day after the due date. If the BOE approves

your request, daily interest will be computed instead of an entire month’s interest, provided all of the following occur:

The electronic payment or prepayment of taxes, fees, or surcharges was made one business day after the date the tax, fee,

surcharge, or prepayment was due.

As provided by Revenue and Taxation Code sections 6591.6, 7655.5, 8876.5, 12631.5, 30281.5, 32252.5, 40101.5, 41095.5,

43155.5, 45153.5, 46154.5, 50112.1, 55042.5, and 60207.5, this request will not be considered for any payment made pursuant to a

deficiency determination, a determination where no return has been filed, or a jeopardy determination issued by the BOE.

You were granted relief from all penalties that applied to the above payment or prepayment.

A request was filed for an oral hearing before the Board.

The filing of this form will constitute your request. Note: If you wish to waive your opportunity to appear at the oral hearing, check

box 1 below.

Use the space below to request interest be computed on a daily basis. (Note: Daily interest accrual is not limited to business days.

Weekends and holidays also accrue interest.) Please attach documentation to support your request if it is available. If you previously

made a payment towards interest for which you are requesting recomputation, please check box 2 below to request a refund. If you make

any future payments towards the interest for which you are requesting recomputation, you must file a claim for refund within six months

from the date of each payment or you will lose the opportunity to obtain a refund of amount(s) paid. Publication 117, Filing a Claim for

Refund, contains information regarding refunds, including form BOE-101, Claim for Refund or Credit. This publication and many others

are available on our website at

I hereby request an oral hearing before the Board to adjust the interest computation from one month to daily for the period(s)

because all the conditions cited above have been met.

(periods)

My electronic payment of $

was made one business day late on

at approximately

am/pm.

(payment)

(time)

(month, day, year)

Relief of penalty was granted on

(Check here if date uncertain or unknown)

(month, day, year)

My payment was made one business day late because:

1. By checking this box, I waive the opportunity to appear and be represented at the oral hearing. I request the Board decide the

matter on the basis of the written record on file.

2. By checking this box, I hereby request a refund of the amount paid for interest in excess of the computed daily interest. (BOE-101,

Claim for Refund or Credit, is not necessary.)

SIGNATURE

TITLE

DATE

PRINT NAME

EMAIL ADDRESS

BUSINESS TELEPHONE

(

)

MAILING ADDRESS

CITY

STATE

ZIP

Unless you have been directed by a BOE staff person to send this form directly to that person, you may send your completed form to one

of the offices listed below based on the tax or fee program involved.

PROPERTY AND SPECIAL TAXES DEPARTMENT

SALES AND USE TAX DEPARTMENT

Sales and Use Tax

Vehicles, Vessels or Aircraft

Special Taxes and Fees

Motor Carrier Office

Board of Equalization

Board of Equalization

Board of Equalization

Board of Equalization

Return Analysis Unit, MIC:35

Consumer Use Tax Section, MIC:37

Compliance Branch, MIC:88

Motor Carrier Office, MIC:65

PO Box 942879

PO Box 942879

PO Box 942879

PO Box 942879

Sacramento, CA 94279-0035

Sacramento, CA 94279-0037

Sacramento, CA 94279-0088

Sacramento, CA 94279-0065

CLEAR

PRINT

1

1