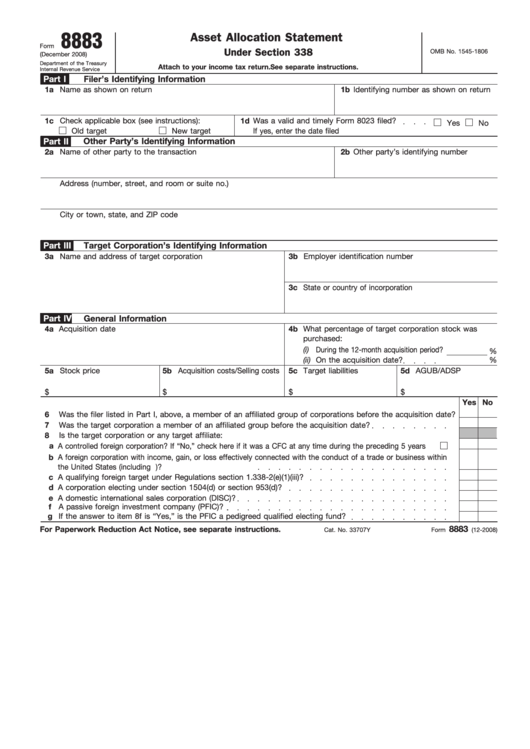

8883

Asset Allocation Statement

Form

Under Section 338

OMB No. 1545-1806

(December 2008)

Department of the Treasury

Attach to your income tax return.

See separate instructions.

Internal Revenue Service

Part I

Filer’s Identifying Information

1a

Name as shown on return

1b

Identifying number as shown on return

1c

Check applicable box (see instructions):

1d

Was a valid and timely Form 8023 filed?

Yes

No

Old target

New target

If yes, enter the date filed

Part II

Other Party’s Identifying Information

2a Name of other party to the transaction

2b

Other party’s identifying number

Address (number, street, and room or suite no.)

City or town, state, and ZIP code

Part III

Target Corporation’s Identifying Information

3a Name and address of target corporation

3b

Employer identification number

3c State or country of incorporation

Part IV

General Information

4a Acquisition date

4b What percentage of target corporation stock was

purchased:

(i)

During the 12-month acquisition period?

%

(ii)

On the acquisition date?

%

5a Stock price

5b Acquisition costs/Selling costs

5c Target liabilities

5d AGUB/ADSP

$

$

$

$

Yes No

6

Was the filer listed in Part I, above, a member of an affiliated group of corporations before the acquisition date?

7

Was the target corporation a member of an affiliated group before the acquisition date?

8

Is the target corporation or any target affiliate:

a A controlled foreign corporation? If “No,” check here if it was a CFC at any time during the preceding 5 years

b A foreign corporation with income, gain, or loss effectively connected with the conduct of a trade or business within

the United States (including U.S. real property interests)?

c A qualifying foreign target under Regulations section 1.338-2(e)(1)(iii)?

d

A corporation electing under section 1504(d) or section 953(d)?

e

A domestic international sales corporation (DISC)?

f

A passive foreign investment company (PFIC)?

g

If the answer to item 8f is “Yes,” is the PFIC a pedigreed qualified electing fund?

8883

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 33707Y

Form

(12-2008)

1

1 2

2