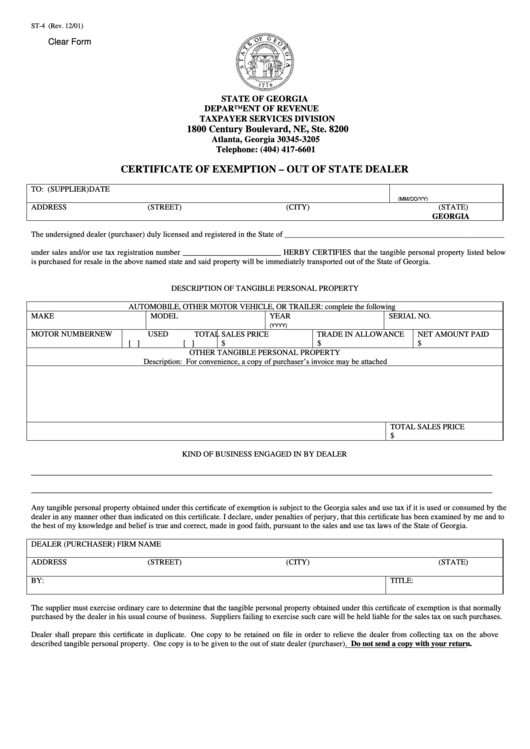

ST-4 (Rev. 12/01)

Clear Form

STATE OF GEORGIA

DEPARTMENT OF REVENUE

TAXPAYER SERVICES DIVISION

1800 Century Boulevard, NE, Ste. 8200

Atlanta, Georgia 30345-3205

Telephone: (404) 417-6601

CERTIFICATE OF EXEMPTION – OUT OF STATE DEALER

TO: (SUPPLIER)

DATE

(MM/DD/YY)

ADDRESS

(STREET)

(CITY)

(STATE)

GEORGIA

The undersigned dealer (purchaser) duly licensed and registered in the State of ________________________________________________________

under sales and/or use tax registration number _________________________ HERBY CERTIFIES that the tangible personal property listed below

is purchased for resale in the above named state and said property will be immediately transported out of the State of Georgia.

DESCRIPTION OF TANGIBLE PERSONAL PROPERTY

AUTOMOBILE, OTHER MOTOR VEHICLE, OR TRAILER: complete the following

MAKE

MODEL

YEAR

SERIAL NO.

(YYYY)

MOTOR NUMBER

NEW

USED

TOTAL SALES PRICE

TRADE IN ALLOWANCE

NET AMOUNT PAID

[ ]

[ ]

$

$

$

OTHER TANGIBLE PERSONAL PROPERTY

Description: For convenience, a copy of purchaser’s invoice may be attached

TOTAL SALES PRICE

$

KIND OF BUSINESS ENGAGED IN BY DEALER

________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

Any tangible personal property obtained under this certificate of exemption is subject to the Georgia sales and use tax if it is used or consumed by the

dealer in any manner other than indicated on this certificate. I declare, under penalties of perjury, that this certificate has been examined by me and to

the best of my knowledge and belief is true and correct, made in good faith, pursuant to the sales and use tax laws of the State of Georgia.

DEALER (PURCHASER) FIRM NAME

ADDRESS

(STREET)

(CITY)

(STATE)

BY:

TITLE:

The supplier must exercise ordinary care to determine that the tangible personal property obtained under this certificate of exemption is that normally

purchased by the dealer in his usual course of business. Suppliers failing to exercise such care will be held liable for the sales tax on such purchases.

Dealer shall prepare this certificate in duplicate. One copy to be retained on file in order to relieve the dealer from collecting tax on the above

described tangible personal property. One copy is to be given to the out of state dealer (purchaser). Do not send a copy with your return.

1

1