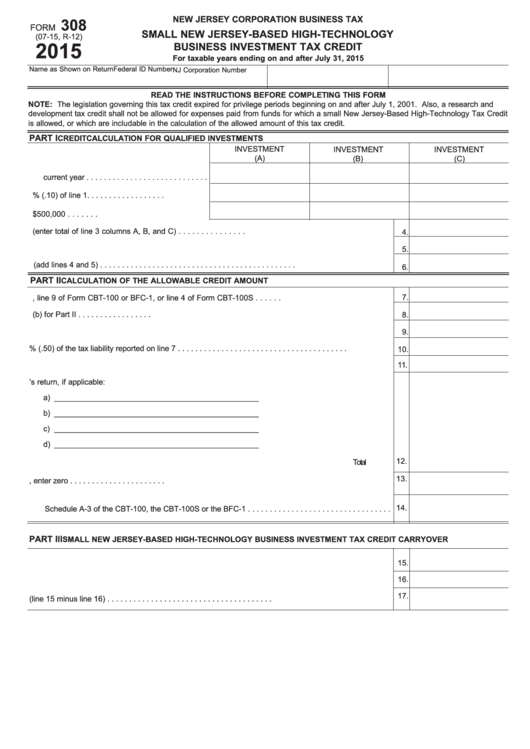

NEW JERSEY CORPORATION BUSINESS TAX

308

FORM

SMALL NEW JERSEY-BASED HIGH-TECHNOLOGY

(07-15, R-12)

BUSINESS INVESTMENT TAX CREDIT

2015

For taxable years ending on and after July 31, 2015

Name as Shown on Return

Federal ID Number

NJ Corporation Number

READ THE INSTRUCTIONS BEFORE COMPLETING THIS FORM

NOTE: The legislation governing this tax credit expired for privilege periods beginning on and after July 1, 2001. Also, a research and

development tax credit shall not be allowed for expenses paid from funds for which a small New Jersey-Based High-Technology Tax Credit

is allowed, or which are includable in the calculation of the allowed amount of this tax credit.

PART I

CREDIT CALCULATION FOR QUALIFIED INVESTMENTS

INVESTMENT

INVESTMENT

INVESTMENT

(A)

(B)

(C)

1. Enter amount of each investment made during

current year . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Enter 10% (.10) of line 1. . . . . . . . . . . . . . . . . .

3. Enter the lesser of line 2 or $500,000 . . . . . . .

4. Amount available for credit this tax year (enter total of line 3 columns A, B, and C) . . . . . . . . . . . . . . .

4.

5. Small New Jersey-Based High-Technology Tax Credit carried forward from the prior tax year . . . . . .

5.

6. Total tax credit available (add lines 4 and 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

PART II

CALCULATION OF THE ALLOWABLE CREDIT AMOUNT

7.

7. Enter tax liability from page 1, line 9 of Form CBT-100 or BFC-1, or line 4 of Form CBT-100S . . . . . .

8. Enter the required minimum tax liability as indicated in instruction (b) for Part II . . . . . . . . . . . . . . . . .

8.

9. Subtract line 8 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

10. Enter 50% (.50) of the tax liability reported on line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

11.

11. Enter the lesser of line 9 or line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Tax credits taken on current year’s return, if applicable:

a) ________________________

________________________

b) ________________________

________________________

c) ________________________

________________________

d) ________________________

________________________

12.

Total

13.

13. Subtract line 12 from line 11. If the result is less than zero, enter zero . . . . . . . . . . . . . . . . . . . . . .

14. Allowable credit for the current tax period. Enter the lesser of line 6 or line 13 here and on

14.

Schedule A-3 of the CBT-100, the CBT-100S or the BFC-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART III

SMALL NEW JERSEY-BASED HIGH-TECHNOLOGY BUSINESS INVESTMENT TAX CREDIT CARRYOVER

15. Enter amount from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.

16.

16. Enter amount from line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17.

17. Amount of tax credit carryover (line 15 minus line 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

1 2

2 3

3