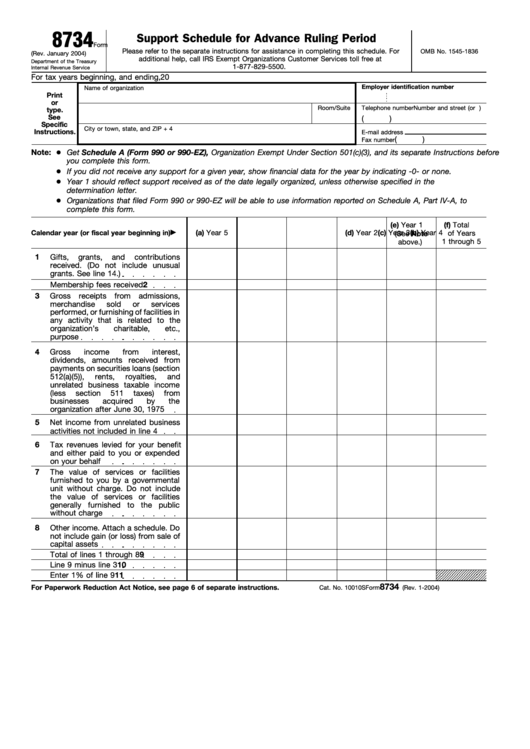

8734

Support Schedule for Advance Ruling Period

Form

Please refer to the separate instructions for assistance in completing this schedule. For

OMB No. 1545-1836

(Rev. January 2004)

additional help, call IRS Exempt Organizations Customer Services toll free at

Department of the Treasury

1-877-829-5500.

Internal Revenue Service

For tax years beginning

, and ending

, 20

Employer identification number

Name of organization

Print

or

Number and street (or P.O. box number if mail is not delivered to street address)

Room/Suite

Telephone number

type.

See

(

)

Specific

City or town, state, and ZIP + 4

Instructions.

E-mail address

(

)

Fax number

● Get Schedule A (Form 990 or 990-EZ), Organization Exempt Under Section 501(c)(3), and its separate Instructions before

Note:

you complete this for m.

● If you did not receive any support for a given year, show financial data for the year by indicating -0- or none.

● Year 1 should reflect support received as of the date legally organized, unless otherwise specified in the

deter mination letter.

● Organizations that filed For m 990 or 990-EZ will be able to use information reported on Schedule A, Part IV-A, to

complete this for m.

(e) Year 1

(f) Total

Calendar year (or fiscal year beginning in)

(a) Year 5

(b) Year 4

(c) Year 3

(d) Year 2

of Years

(See Note

1 through 5

above.)

1

Gifts,

grants,

and

contributions

received. (Do not include unusual

grants. See line 14.)

2

Membership fees received

3

Gross receipts from admissions,

merchandise

sold

or

services

performed, or furnishing of facilities in

any activity that is related to the

organization’s

charitable,

etc.,

purpose

4

Gross

income

from

interest,

dividends, amounts received from

payments on securities loans (section

512(a)(5)),

rents,

royalties,

and

unrelated business taxable income

(less

section

511

taxes)

from

businesses

acquired

by

the

organization after June 30, 1975

5

Net income from unrelated business

activities not included in line 4

6

Tax revenues levied for your benefit

and either paid to you or expended

on your behalf

7

The value of services or facilities

furnished to you by a governmental

unit without charge. Do not include

the value of services or facilities

generally furnished to the public

without charge

8

Other income. Attach a schedule. Do

not include gain (or loss) from sale of

capital assets

9

Total of lines 1 through 8

10

Line 9 minus line 3

11

Enter 1% of line 9

8734

For Paperwork Reduction Act Notice, see page 6 of separate instructions.

Cat. No. 10010S

Form

(Rev. 1-2004)

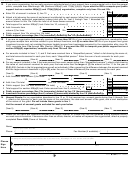

1

1 2

2