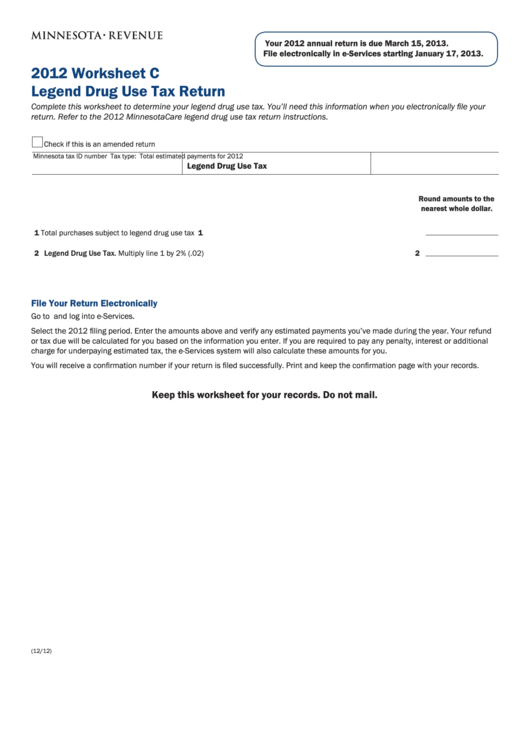

Your 2012 annual return is due March 15, 2013.

File electronically in e-Services starting January 17, 2013.

2012 Worksheet C

Legend Drug Use Tax Return

Complete this worksheet to determine your legend drug use tax. You’ll need this information when you electronically file your

return. Refer to the 2012 MinnesotaCare legend drug use tax return instructions.

Check if this is an amended return

Minnesota tax ID number

Tax type:

Total estimated payments for 2012

Legend Drug Use Tax

Round amounts to the

nearest whole dollar.

1 Total purchases subject to legend drug use tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Legend Drug Use Tax. Multiply line 1 by 2% ( .02) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

File Your Return Electronically

Go to and log into e-Services .

Select the 2012 filing period. Enter the amounts above and verify any estimated payments you’ve made during the year. Your refund

or tax due will be calculated for you based on the information you enter. If you are required to pay any penalty, interest or additional

charge for underpaying estimated tax, the e-Services system will also calculate these amounts for you.

You will receive a confirmation number if your return is filed successfully. Print and keep the confirmation page with your records.

Keep this worksheet for your records. Do not mail.

(12/12)

1

1