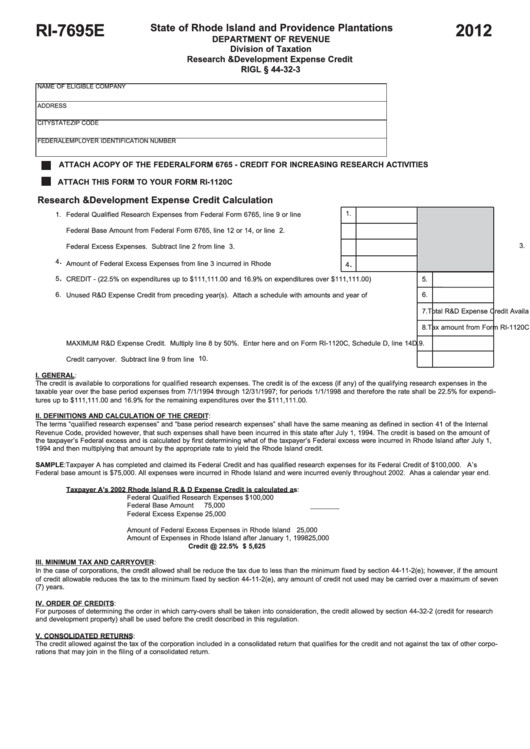

RI-7695E

State of Rhode Island and Providence Plantations

2012

DEPARTMENT OF REVENUE

Division of Taxation

Research & Development Expense Credit

RIGL § 44-32-3

NAME OF ELIGIBLE COMPANY

ADDRESS

CITY

STATE

ZIP CODE

FEDERAL EMPLOYER IDENTIFICATION NUMBER

ATTACH A COPY OF THE FEDERAL FORM 6765 - CREDIT FOR INCREASING RESEARCH ACTIVITIES

ATTACH THIS FORM TO YOUR FORM RI-1120C

Research & Development Expense Credit Calculation

1.

1.

Federal Qualified Research Expenses from Federal Form 6765, line 9 or line 28.................

2.

2.

Federal Base Amount from Federal Form 6765, line 12 or 14, or line 30...............................

3.

3.

Federal Excess Expenses. Subtract line 2 from line 1...........................................................

.

4

.

Amount of Federal Excess Expenses from line 3 incurred in Rhode Island...........................

4

.

5

CREDIT - (22.5% on expenditures up to $111,111.00 and 16.9% on expenditures over $111,111.00) ..........................

5.

6.

6.

Unused R&D Expense Credit from preceding year(s). Attach a schedule with amounts and year of origination..........

7.

Total R&D Expense Credit Available. Add lines 5 and 6.................................................................................................

7.

8.

Tax amount from Form RI-1120C, line 13........................................................................................................................

8.

9.

9.

MAXIMUM R&D Expense Credit. Multiply line 8 by 50%. Enter here and on Form RI-1120C, Schedule D, line 14D.

10.

10.

Credit carryover. Subtract line 9 from line 7...................................................................................................................

I. GENERAL:

The credit is available to corporations for qualified research expenses. The credit is of the excess (if any) of the qualifying research expenses in the

taxable year over the base period expenses from 7/1/1994 through 12/31/1997; for periods 1/1/1998 and therefore the rate shall be 22.5% for expendi-

tures up to $111,111.00 and 16.9% for the remaining expenditures over the $111,111.00.

II. DEFINITIONS AND CALCULATION OF THE CREDIT:

The terms “qualified research expenses” and “base period research expenses” shall have the same meaning as defined in section 41 of the Internal

Revenue Code, provided however, that such expenses shall have been incurred in this state after July 1, 1994. The credit is based on the amount of

the taxpayer’s Federal excess and is calculated by first determining what of the taxpayer’s Federal excess were incurred in Rhode Island after July 1,

1994 and then multiplying that amount by the appropriate rate to yield the Rhode Island credit.

SAMPLE:Taxpayer A has completed and claimed its Federal Credit and has qualified research expenses for its Federal Credit of $100,000. A’s

Federal base amount is $75,000. All expenses were incurred in Rhode Island and were incurred evenly throughout 2002. A has a calendar year end.

Taxpayer A’s 2002 Rhode Island R & D Expense Credit is calculated as:

Federal Qualified Research Expenses

$100,000

Federal Base Amount

75,000

Federal Excess Expense

25,000

Amount of Federal Excess Expenses in Rhode Island

25,000

Amount of Expenses in Rhode Island after January 1, 1998

25,000

Credit @ 22.5%

$ 5,625

III. MINIMUM TAX AND CARRYOVER:

In the case of corporations, the credit allowed shall be reduce the tax due to less than the minimum fixed by section 44-11-2(e); however, if the amount

of credit allowable reduces the tax to the minimum fixed by section 44-11-2(e), any amount of credit not used may be carried over a maximum of seven

(7) years.

IV. ORDER OF CREDITS:

For purposes of determining the order in which carry-overs shall be taken into consideration, the credit allowed by section 44-32-2 (credit for research

and development property) shall be used before the credit described in this regulation.

V. CONSOLIDATED RETURNS:

The credit allowed against the tax of the corporation included in a consolidated return that qualifies for the credit and not against the tax of other corpo-

rations that may join in the filing of a consolidated return.

1

1