Form Ri-2874 - Employer'S Apprenticeship Credit - 2012

ADVERTISEMENT

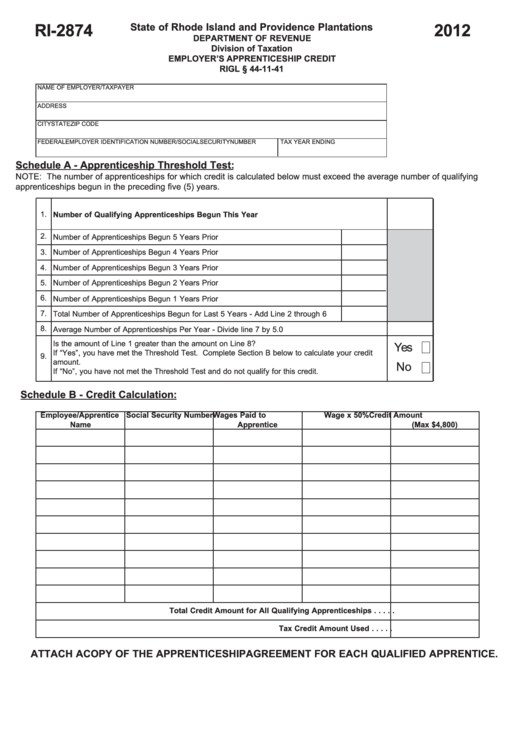

State of Rhode Island and Providence Plantations

RI-2874

2012

DEPARTMENT OF REVENUE

Division of Taxation

EMPLOYER’S APPRENTICESHIP CREDIT

RIGL § 44-11-41

NAME OF EMPLOYER/TAXPAYER

ADDRESS

CITY

STATE

ZIP CODE

FEDERAL EMPLOYER IDENTIFICATION NUMBER/SOCIAL SECURITY NUMBER

TAX YEAR ENDING

Schedule A - Apprenticeship Threshold Test:

NOTE: The number of apprenticeships for which credit is calculated below must exceed the average number of qualifying

apprenticeships begun in the preceding five (5) years.

1.

Number of Qualifying Apprenticeships Begun This Year

2.

Number of Apprenticeships Begun 5 Years Prior

3.

Number of Apprenticeships Begun 4 Years Prior

4.

Number of Apprenticeships Begun 3 Years Prior

5.

Number of Apprenticeships Begun 2 Years Prior

6.

Number of Apprenticeships Begun 1 Years Prior

7.

Total Number of Apprenticeships Begun for Last 5 Years - Add Line 2 through 6

8.

Average Number of Apprenticeships Per Year - Divide line 7 by 5.0

Is the amount of Line 1 greater than the amount on Line 8?

Yes

If “Yes”, you have met the Threshold Test. Complete Section B below to calculate your credit

9.

amount.

No

If “No”, you have not met the Threshold Test and do not qualify for this credit.

Schedule B - Credit Calculation:

Employee/Apprentice

Social Security Number

Wages Paid to

Wage x 50%

Credit Amount

Name

Apprentice

(Max $4,800)

Total Credit Amount for All Qualifying Apprenticeships . . . . .

Tax Credit Amount Used . . . . .

ATTACH A COPY OF THE APPRENTICESHIP AGREEMENT FOR EACH QUALIFIED APPRENTICE.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2