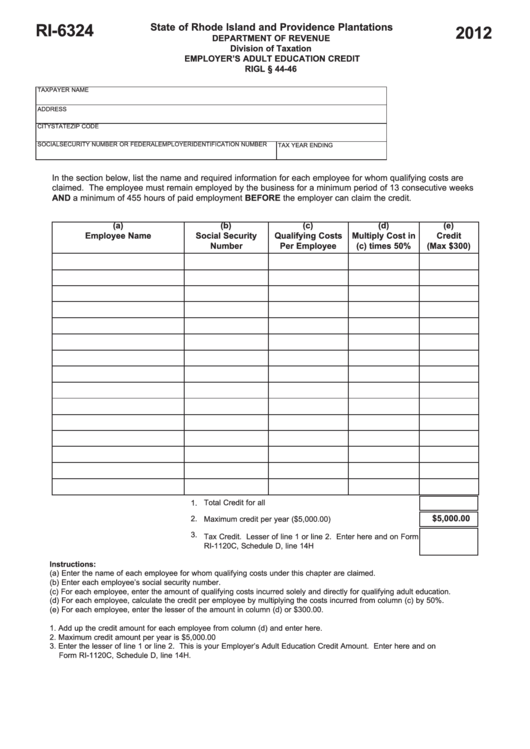

State of Rhode Island and Providence Plantations

RI-6324

2012

DEPARTMENT OF REVENUE

Division of Taxation

EMPLOYER’S ADULT EDUCATION CREDIT

RIGL § 44-46

TAXPAYER NAME

ADDRESS

CITY

STATE

ZIP CODE

SOCIAL SECURITY NUMBER OR FEDERAL EMPLOYER IDENTIFICATION NUMBER

TAX YEAR ENDING

In the section below, list the name and required information for each employee for whom qualifying costs are

claimed. The employee must remain employed by the business for a minimum period of 13 consecutive weeks

AND a minimum of 455 hours of paid employment BEFORE the employer can claim the credit.

(a)

(b)

(c)

(d)

(e)

Employee Name

Social Security

Qualifying Costs

Multiply Cost in

Credit

Number

Per Employee

(c) times 50%

(Max $300)

1.

Total Credit for all employees......................................................

$5,000.00

2.

Maximum credit per year ($5,000.00).........................................

3.

Tax Credit. Lesser of line 1 or line 2. Enter here and on Form

RI-1120C, Schedule D, line 14H ................................................

Instructions:

(a) Enter the name of each employee for whom qualifying costs under this chapter are claimed.

(b) Enter each employee’s social security number.

(c) For each employee, enter the amount of qualifying costs incurred solely and directly for qualifying adult education.

(d) For each employee, calculate the credit per employee by multiplying the costs incurred from column (c) by 50%.

(e) For each employee, enter the lesser of the amount in column (d) or $300.00.

1. Add up the credit amount for each employee from column (d) and enter here.

2. Maximum credit amount per year is $5,000.00

3. Enter the lesser of line 1 or line 2. This is your Employer’s Adult Education Credit Amount. Enter here and on

Form RI-1120C, Schedule D, line 14H.

1

1 2

2