Form Ri-100 - Basic Instructions

ADVERTISEMENT

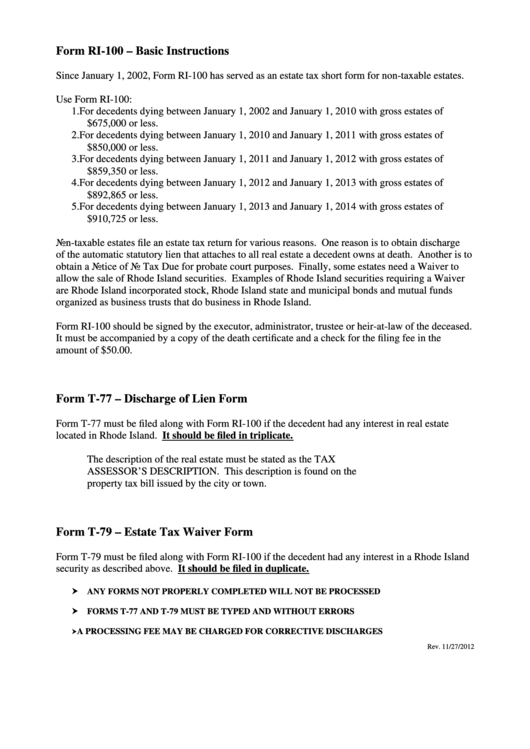

Form RI-100 – Basic Instructions

Since January 1, 2002, Form RI-100 has served as an estate tax short form for non-taxable estates.

Use Form RI-100:

1. For decedents dying between January 1, 2002 and January 1, 2010 with gross estates of

$675,000 or less.

2. For decedents dying between January 1, 2010 and January 1, 2011 with gross estates of

$850,000 or less.

3. For decedents dying between January 1, 2011 and January 1, 2012 with gross estates of

$859,350 or less.

4. For decedents dying between January 1, 2012 and January 1, 2013 with gross estates of

$892,865 or less.

5. For decedents dying between January 1, 2013 and January 1, 2014 with gross estates of

$910,725 or less.

Non-taxable estates file an estate tax return for various reasons. One reason is to obtain discharge

of the automatic statutory lien that attaches to all real estate a decedent owns at death. Another is to

obtain a Notice of No Tax Due for probate court purposes. Finally, some estates need a Waiver to

allow the sale of Rhode Island securities. Examples of Rhode Island securities requiring a Waiver

are Rhode Island incorporated stock, Rhode Island state and municipal bonds and mutual funds

organized as business trusts that do business in Rhode Island.

Form RI-100 should be signed by the executor, administrator, trustee or heir-at-law of the deceased.

It must be accompanied by a copy of the death certificate and a check for the filing fee in the

amount of $50.00.

Form T-77 – Discharge of Lien Form

Form T-77 must be filed along with Form RI-100 if the decedent had any interest in real estate

located in Rhode Island. It should be filed in triplicate.

The description of the real estate must be stated as the TAX

ASSESSOR’S DESCRIPTION. This description is found on the

property tax bill issued by the city or town.

Form T-79 – Estate Tax Waiver Form

Form T-79 must be filed along with Form RI-100 if the decedent had any interest in a Rhode Island

security as described above. It should be filed in duplicate.

ANY FORMS NOT PROPERLY COMPLETED WILL NOT BE PROCESSED

FORMS T-77 AND T-79 MUST BE TYPED AND WITHOUT ERRORS

A PROCESSING FEE MAY BE CHARGED FOR CORRECTIVE DISCHARGES

Rev. 11/27/2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1