Form Wtd - Withholding Tax Return

ADVERTISEMENT

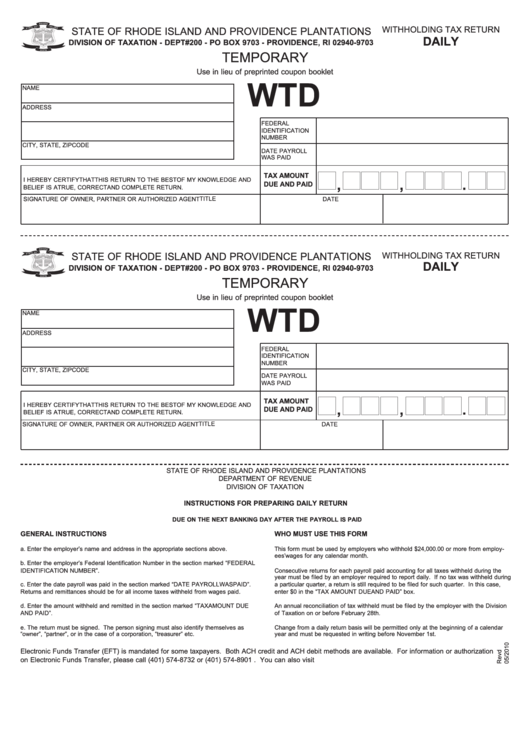

WITHHOLDING TAX RETURN

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS

DAILY

DIVISION OF TAXATION - DEPT#200 - PO BOX 9703 - PROVIDENCE, RI 02940-9703

TEMPORARY

Use in lieu of preprinted coupon booklet

WTD

NAME

ADDRESS

FEDERAL

IDENTIFICATION

NUMBER

CITY, STATE, ZIP CODE

DATE PAYROLL

WAS PAID

TAX AMOUNT

I HEREBY CERTIFY THAT THIS RETURN TO THE BEST OF MY KNOWLEDGE AND

,

,

.

DUE AND PAID

BELIEF IS A TRUE, CORRECT AND COMPLETE RETURN.

SIGNATURE OF OWNER, PARTNER OR AUTHORIZED AGENT

TITLE

DATE

WITHHOLDING TAX RETURN

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS

DAILY

DIVISION OF TAXATION - DEPT#200 - PO BOX 9703 - PROVIDENCE, RI 02940-9703

TEMPORARY

Use in lieu of preprinted coupon booklet

WTD

NAME

ADDRESS

FEDERAL

IDENTIFICATION

NUMBER

CITY, STATE, ZIP CODE

DATE PAYROLL

WAS PAID

TAX AMOUNT

I HEREBY CERTIFY THAT THIS RETURN TO THE BEST OF MY KNOWLEDGE AND

,

,

.

DUE AND PAID

BELIEF IS A TRUE, CORRECT AND COMPLETE RETURN.

TITLE

SIGNATURE OF OWNER, PARTNER OR AUTHORIZED AGENT

DATE

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS

DEPARTMENT OF REVENUE

DIVISION OF TAXATION

INSTRUCTIONS FOR PREPARING DAILY RETURN

DUE ON THE NEXT BANKING DAY AFTER THE PAYROLL IS PAID

GENERAL INSTRUCTIONS

WHO MUST USE THIS FORM

a. Enter the employer’s name and address in the appropriate sections above.

This form must be used by employers who withhold $24,000.00 or more from employ-

ees’ wages for any calendar month.

b. Enter the employer’s Federal Identification Number in the section marked “FEDERAL

IDENTIFICATION NUMBER”.

Consecutive returns for each payroll paid accounting for all taxes withheld during the

year must be filed by an employer required to report daily. If no tax was withheld during

c. Enter the date payroll was paid in the section marked “DATE PAYROLL WAS PAID”.

a particular quarter, a return is still required to be filed for such quarter. In this case,

Returns and remittances should be for all income taxes withheld from wages paid.

enter $0 in the “TAX AMOUNT DUE AND PAID” box.

d. Enter the amount withheld and remitted in the section marked “TAX AMOUNT DUE

An annual reconciliation of tax withheld must be filed by the employer with the Division

AND PAID”.

of Taxation on or before February 28th.

e. The return must be signed. The person signing must also identify themselves as

Change from a daily return basis will be permitted only at the beginning of a calendar

“owner”, “partner”, or in the case of a corporation, “treasurer” etc.

year and must be requested in writing before November 1st.

Electronic Funds Transfer (EFT) is mandated for some taxpayers. Both ACH credit and ACH debit methods are available. For information or authorization

on Electronic Funds Transfer, please call (401) 574-8732 or (401) 574-8901 . You can also visit for more information.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1