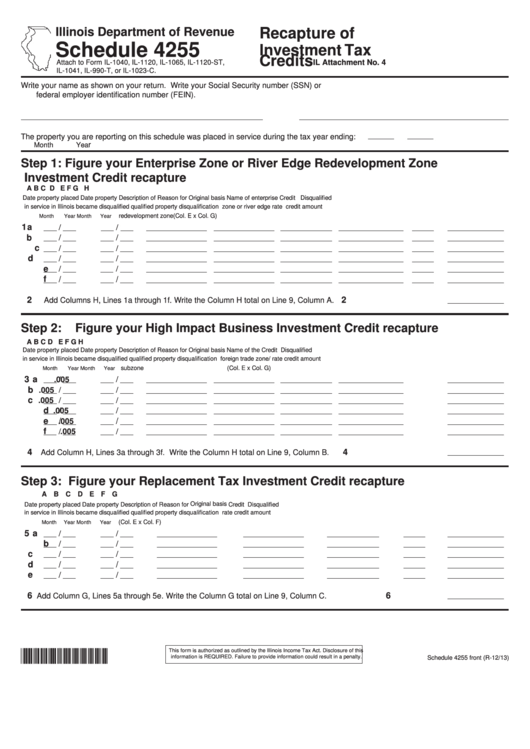

Recapture of

Illinois Department of Revenue

Schedule 4255

Investment Tax

Attach to Form IL-1040, IL-1120, IL-1065, IL-1120-ST,

Credits

IL Attachment No. 4

IL-1041, IL-990-T, or IL-1023-C.

Write your name as shown on your return.

Write your Social Security number (SSN) or

federal employer identification number (FEIN).

The property you are reporting on this schedule was placed in service during the tax year ending:

r

Month

Yea

Step 1: Figure your Enterprise Zone or River Edge Redevelopment Zone

Investment Credit recapture

A

B

C

D

E

F

G

H

Date property placed

Date property

Description of

Reason for

Original basis

Name of enterprise

Credit

Disqualified

in service in Illinois became disqualified

qualified property

disqualification

zone or river edge

rate

credit amount

redevelopment zone

(Col. E x Col. G)

Month

Year

Month

Year

1 a

b

c

d

e

f

Add Columns H, Lines 1a through 1f. Write the Column H total on Line 9, Column A.

2

2

Step 2: Figure your High Impact Business Investment Credit recapture

A

B

C

D

E

F

G

H

Date property placed

Date property

Description of

Reason for

Original basis

Name of the

Credit

Disqualified

in service in Illinois became disqualified

qualified property

disqualification

foreign trade zone/

rate

credit amount

subzone

(Col. E x Col. G)

Month

Year

Month

Year

3 a

.005

b

.005

c

.005

d

.005

e

.005

f

.005

Add Column H, Lines 3a through 3f. Write the Column H total on Line 9, Column B.

4

4

Step 3: Figure your Replacement Tax Investment Credit recapture

A

B

C

D

E

F

G

Original basis

Date property placed

Date property

Description of

Reason for

Credit

Disqualified

in service in Illinois became disqualified

qualified property

disqualification

rate

credit amount

(Col. E x Col. F)

Month

Year

Month

Year

5 a

b

c

d

e

Add Column G, Lines 5a through 5e. Write the Column G total on Line 9, Column C.

6

6

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

*362301110*

information is REQUIRED. Failure to provide information could result in a penalty.

Schedule 4255 front (R-12/13)

1

1 2

2