Form Ef-V - Business Filers Income Tax Payment Voucher - State Of Oklahoma - 2014

ADVERTISEMENT

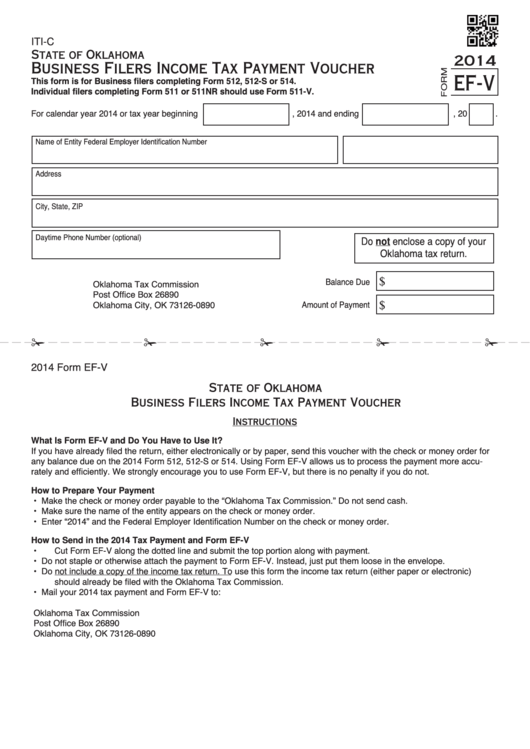

ITI-C

State of Oklahoma

2014

Business Filers Income Tax Payment Voucher

EF-V

This form is for Business filers completing Form 512, 512-S or 514.

Individual filers completing Form 511 or 511NR should use Form 511-V.

For calendar year 2014 or tax year beginning

, 2014 and ending

, 20

.

Name of Entity

Federal Employer Identification Number

Address

City, State, ZIP

Daytime Phone Number (optional)

Do not enclose a copy of your

Oklahoma tax return.

Balance Due

$

Oklahoma Tax Commission

Post Office Box 26890

Amount of Payment

Oklahoma City, OK 73126-0890

$

!

!

!

!

!

2014 Form EF-V

State of Oklahoma

Business Filers Income Tax Payment Voucher

Instructions

What Is Form EF-V and Do You Have to Use It?

If you have already filed the return, either electronically or by paper, send this voucher with the check or money order for

any balance due on the 2014 Form 512, 512-S or 514. Using Form EF-V allows us to process the payment more accu-

rately and efficiently. We strongly encourage you to use Form EF-V, but there is no penalty if you do not.

How to Prepare Your Payment

• Make the check or money order payable to the “Oklahoma Tax Commission.” Do not send cash.

• Make sure the name of the entity appears on the check or money order.

• Enter “2014” and the Federal Employer Identification Number on the check or money order.

How to Send in the 2014 Tax Payment and Form EF-V

• Cut Form EF-V along the dotted line and submit the top portion along with payment.

• Do not staple or otherwise attach the payment to Form EF-V. Instead, just put them loose in the envelope.

• Do not include a copy of the income tax return. To use this form the income tax return (either paper or electronic)

should already be filed with the Oklahoma Tax Commission.

• Mail your 2014 tax payment and Form EF-V to:

Oklahoma Tax Commission

Post Office Box 26890

Oklahoma City, OK 73126-0890

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1