Areas Of Recurring Taxpayer Noncompliance - Indiana Department Of Revenue Annual Report

ADVERTISEMENT

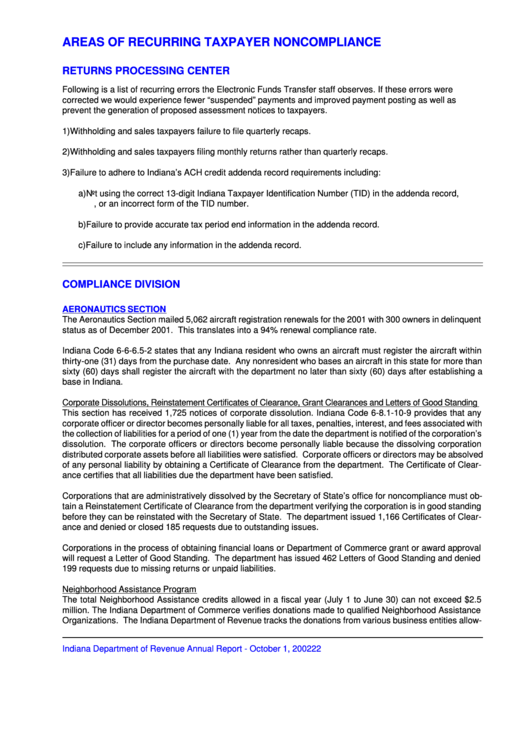

AREAS OF RECURRING TAXPAYER NONCOMPLIANCE

RETURNS PROCESSING CENTER

Following is a list of recurring errors the Electronic Funds Transfer staff observes. If these errors were

corrected we would experience fewer “suspended” payments and improved payment posting as well as

prevent the generation of proposed assessment notices to taxpayers.

1) Withholding and sales taxpayers failure to file quarterly recaps.

2) Withholding and sales taxpayers filing monthly returns rather than quarterly recaps.

3) Failure to adhere to Indiana’s ACH credit addenda record requirements including:

a) Not using the correct 13-digit Indiana Taxpayer Identification Number (TID) in the addenda record,

e.g. using the Federal ID number, or an incorrect form of the TID number.

b) Failure to provide accurate tax period end information in the addenda record.

c) Failure to include any information in the addenda record.

COMPLIANCE DIVISION

AERONAUTICS SECTION

The Aeronautics Section mailed 5,062 aircraft registration renewals for the 2001 with 300 owners in delinquent

status as of December 2001. This translates into a 94% renewal compliance rate.

Indiana Code 6-6-6.5-2 states that any Indiana resident who owns an aircraft must register the aircraft within

thirty-one (31) days from the purchase date. Any nonresident who bases an aircraft in this state for more than

sixty (60) days shall register the aircraft with the department no later than sixty (60) days after establishing a

base in Indiana.

Corporate Dissolutions, Reinstatement Certificates of Clearance, Grant Clearances and Letters of Good Standing

This section has received 1,725 notices of corporate dissolution. Indiana Code 6-8.1-10-9 provides that any

corporate officer or director becomes personally liable for all taxes, penalties, interest, and fees associated with

the collection of liabilities for a period of one (1) year from the date the department is notified of the corporation’s

dissolution. The corporate officers or directors become personally liable because the dissolving corporation

distributed corporate assets before all liabilities were satisfied. Corporate officers or directors may be absolved

of any personal liability by obtaining a Certificate of Clearance from the department. The Certificate of Clear-

ance certifies that all liabilities due the department have been satisfied.

Corporations that are administratively dissolved by the Secretary of State’s office for noncompliance must ob-

tain a Reinstatement Certificate of Clearance from the department verifying the corporation is in good standing

before they can be reinstated with the Secretary of State. The department issued 1,166 Certificates of Clear-

ance and denied or closed 185 requests due to outstanding issues.

Corporations in the process of obtaining financial loans or Department of Commerce grant or award approval

will request a Letter of Good Standing. The department has issued 462 Letters of Good Standing and denied

199 requests due to missing returns or unpaid liabilities.

Neighborhood Assistance Program

The total Neighborhood Assistance credits allowed in a fiscal year (July 1 to June 30) can not exceed $2.5

million. The Indiana Department of Commerce verifies donations made to qualified Neighborhood Assistance

Organizations. The Indiana Department of Revenue tracks the donations from various business entities allow-

Indiana Department of Revenue Annual Report - October 1, 2002

22

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3