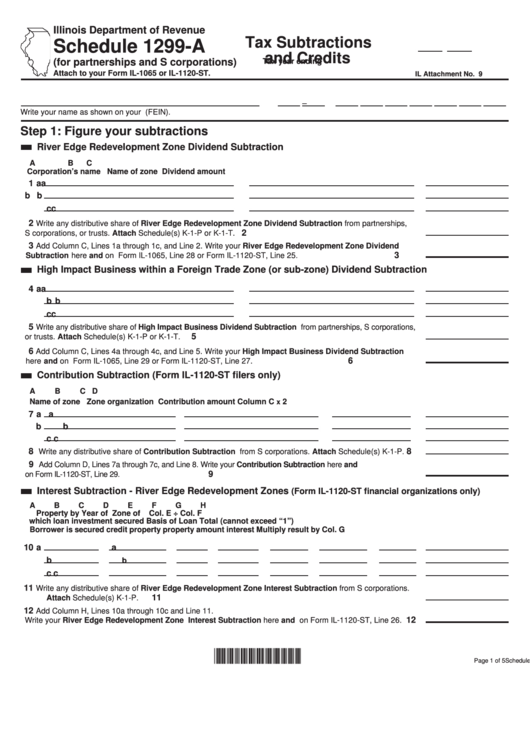

Illinois Department of Revenue

Tax Subtractions

Schedule 1299-A

and Credits

(for partnerships and S corporations)

Tax year ending

Attach to your Form IL-1065 or IL-1120-ST.

IL Attachment No. 9

–

Write your name as shown on your return.

Write your federal employer identification number (FEIN).

Step 1: Figure your subtractions

River Edge Redevelopment Zone Dividend Subtraction

A

B

C

Corporation’s name

Name of zone

Dividend amount

1 a

a

b

b

c

c

Write any distributive share of River Edge Redevelopment Zone Dividend Subtraction from partnerships,

2

S corporations, or trusts. Attach Schedule(s) K-1-P or K-1-T.

2

Add Column C, Lines 1a through 1c, and Line 2. Write your River Edge Redevelopment Zone Dividend

3

Subtraction here and on Form IL-1065, Line 28 or Form IL-1120-ST, Line 25.

3

High Impact Business within a Foreign Trade Zone (or sub-zone) Dividend Subtraction

4 a

a

b

b

c

c

Write any distributive share of High Impact Business Dividend Subtraction from partnerships, S corporations,

5

or trusts. Attach Schedule(s) K-1-P or K-1-T.

5

Add Column C, Lines 4a through 4c, and Line 5. Write your High Impact Business Dividend Subtraction

6

here and on Form IL-1065, Line 29 or Form IL-1120-ST, Line 27.

6

Contribution Subtraction (Form IL-1120-ST filers only)

A

B

C

D

Name of zone

Zone organization

Contribution amount

Column C

2

x

7 a

a

b

b

c

c

Write any distributive share of Contribution Subtraction from S corporations. Attach Schedule(s) K-1-P.

8

8

Add Column D, Lines 7a through 7c, and Line 8. Write your Contribution Subtraction here and

9

on Form IL-1120-ST, Line 29.

9

Interest Subtraction - River Edge Redevelopment Zones

(Form IL-1120-ST financial organizations only)

A

B

C

D

E

F

G

H

Property by

Year of

Zone of

Col. E ÷ Col. F

which loan

investment

secured

Basis of

Loan

Total

(cannot exceed “1”)

Borrower

is secured

credit

property

property

amount

interest

Multiply result by Col. G

10 a

a

b

b

c

c

Write any distributive share of River Edge Redevelopment Zone Interest Subtraction from S corporations.

11

Attach Schedule(s) K-1-P.

11

Add Column H, Lines 10a through 10c and Line 11.

12

Write your River Edge Redevelopment Zone Interest Subtraction here and on Form IL-1120-ST, Line 26.

12

*334001110*

Page 1 of 5

Schedule 1299-A (R-12/13)

1

1 2

2 3

3 4

4 5

5